Pipeline Online – Articles on Lithium in Saskatchewan

Pipeline Online – Articles on Lithium in Saskatchewan

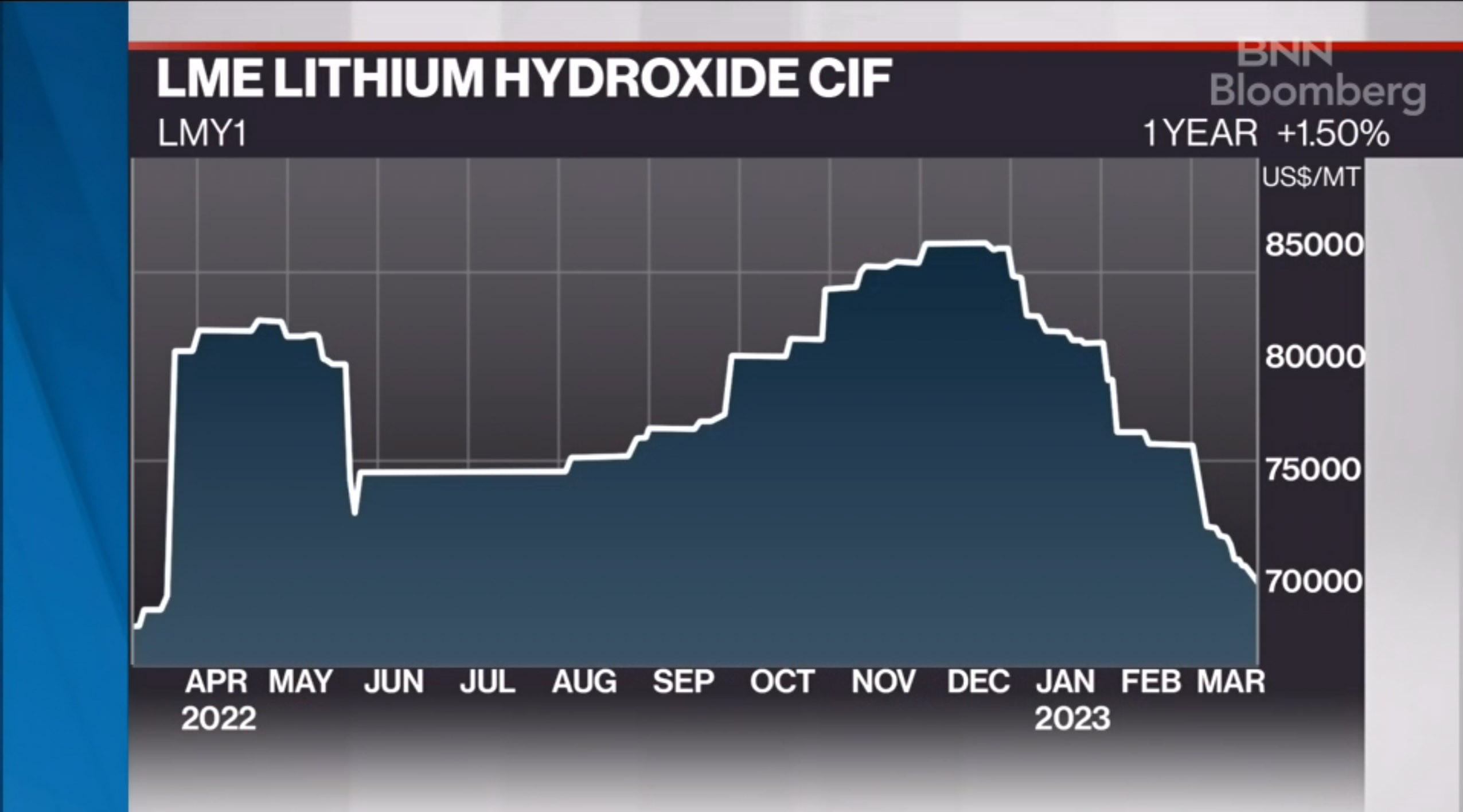

Graphic via BNN Bloomberg

This interview on CNN Bloomberg is rather inciteful on lithium pricing, given that is is by and large an opaque market. Koby Kushner, equity research analyst, Red Cloud Securities is the guest. The interview initially aired on March 23, 2023.

Let’s put this in perspective: Around 2012, I wrote my first story on lithium, and at the time the prices had recently tripled to around US$7,000 a tonne. In the fall of 2021, when Prairie Lithium (which this week was acquired by Arizona Lithium) was drilling the first targeted lithium well in Saskatchewan, the price was US$21,000 a tonne. By the next spring, it was US$65,000 a tonne (see the start of the graph).

The chart in this piece shows lithium had hit as high as US$85,000 a tonne for lithium hydroxide. It has since “come down,” if you can call it that, to US$70,000 a tonne. On March 29, that would equate $95,025 CAD per tonne.

Notably, the lithium explorers in Saskatchewan plan for their projects to be profitable at around $20,000 a tonne. So if the prices stay more than three times that level, that’s a real profit opportunity, if they can make it work. And those explorers are talking about 10,000 tonne per year projects, which means at US$20,000 per tonne, that’s a revenue stream of US$200 million per year. But if it holds at US$70,000, then such facilities would theoretically see annual revenue of US$700 million, or $950 million CAD, per year. And that’s why this is a prospective multi-billion business for Saskatchewan.

Also pay close attention to the B-roll video. See the enormous open pit mines and evaporation ponds? The footprint of Saskatchewan lithium projects will involve wells 9 inches across, an electric submersible pump, a white box on the surface for the variable frequency drive, buried flowlines, and a central processing facility that will look an awful lot like a large oil battery. That’s it.

Lithium in Saskatchewan series to date: