Copper / Silver / Gold News

Mining.com: Copper price: What’s in store for 2025

https://www.mining.com/copper-price-whats-in-store-for-2025/

Copper trading was febrile in 2024 attracting speculators well outside commodity circles who were desperate to connect the metal to what has become the ultimate market pump action – AI.

AI data centers were going to do for copper what the energy transition and electric cars couldn’t, at least not in the short term. Military spending was also hoisted up the flagpole of copper demand to see who saluted, according to chatbots.

Sign Up for the Copper Digest

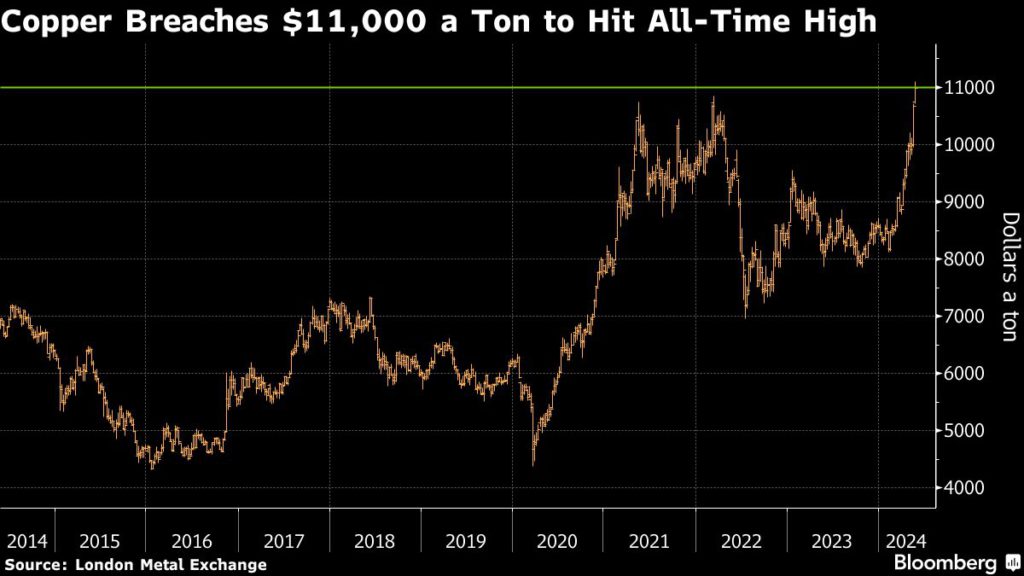

In May, Comex copper hit an all-time intraday high of nearly $5.20 a pound or $11,500 per tonne. Positioning went to such net lengths that dollar trading volumes scaled $100 billion (twice the Dow daily average) in one 24 hour period.

Cooler heads prevailed in London, particularly after it became clear that the squeeze was mainly a US phenomenon and cargoes destined for Rotterdam and Shanghai were soon redirected there. LME futures have yet to visit $11,000 a tonne.

Copper is the new oil

A supposedly never-wrong oil hedge fund manager from France – that bastion of the commodities world – took a pause from the black stuff to forecast $40,000 a tonne for the brown metal over “the next four years or so”.

Perhaps fitting since even those with decades of experience on metals markets got caught up in the excitement, calling copper “the new oil,” the “highest conviction trade ever seen” and predicting a 50% price upside.

But like the head on a badly poured French Blanche the froth on copper markets soon settled.

Managed money longs made another big push at the end of September, this time predicated on a Beijing bazooka of economic stimulus, but the subsequent run up for copper fell well short of what was promised just like the pronouncements of the Standing Committee of the National People’s Congress.

The final blow for copper’s year of living gloriously was Trump’s tariffs and a stronger dollar and it now looks like copper will drift into the new year with most of its 2024 gains given up.

But what’s in store for 2025?

While futures are fun to follow, on and under the ground developments unfold at a slower pace – although even here surprises could be plentiful.

How brown is your valley

Copper markets took the loss of Cobre Panama mostly in stride thanks to Codelco managing to run fast enough to stand still.

Escondida, the only 1mtpa plus copper mine in the world, is also churning out metal with the latest production figures showing a 22% year on year jump, helping to lift overall Chilean output more than 6% compared to last year.

Chile’s mining association said this week copper production will range between 5.4m and 5.6m tonnes in 2025.

While major greenfield mines coming on stream is increasingly fewer and farther between with Malmyzh in Russia (120ktpa) the only entry for 2025, expansions at Almalyk in Uzbekistan (148ktpa), Kamoa Kakula (139ktpa), and QB2 in Chile, Peru’s Las Bambas in Mongolian Oyu Tolgoi each close to 80ktpa will ensure fresh supply in 2025.

Congo contribution

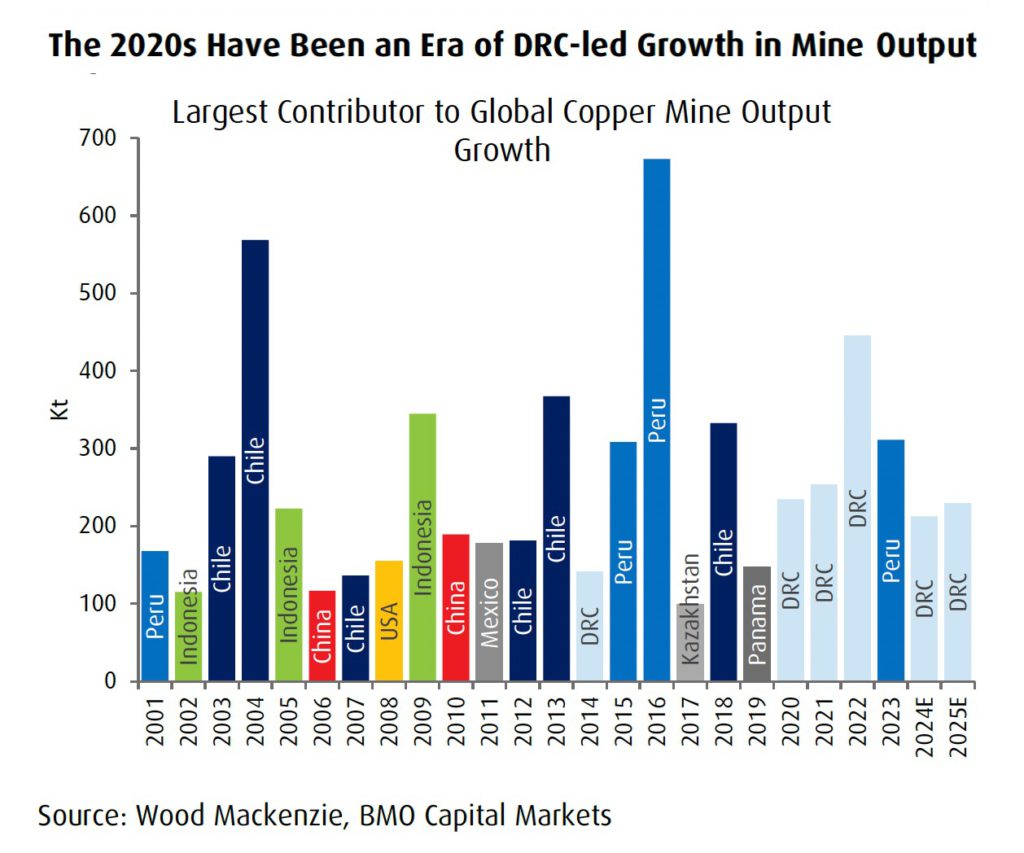

With CMOC’s Tenke Fungurume and Kisanfu firing on all cylinders and ever dependable Kamoa’s contribution the DRC is likely to be once again responsible for the most additional tonnes next year as it has for the past four out of five years.

The last time the US was the greatest contributor was 2008, but the incoming Trump administration positive noises around permitting may see the country once again play its part on copper markets some time in the future.

Copper markets will remain well supplied in 2025 says BMO and at around 2.8% growth will be higher relative to recent history. Macquarie thinks output could rise by as much as 4% in 2024 and with project approvals of nearly 500kt so far in 2024, the pipeline further out may not be as thin as previously thought.

Of grid

On the demand side, the backdrop of the energy transition and the rosy long term outlook for copper is very much still in place, but day-to-day it is still all about China as evidenced by the immediate response of fiscal or monetary stimulus on markets.

Overall China is responsible for around 56% of global copper consumption or around 15mt and Capital Economics in a recent research report argued that a correction in Chinese construction activity “as large as 50% decline from peak to trough” will offset most of the electrification demand.

RBC Capital Markets expects global copper demand growth of 2.9% year-over-year in 2025 with the bulk of the growth coming from outside China which will only expand by 1%.

BMO Capital Markets are more optimistic modelling 2.2% growth in China next year. Next year’s state grid budget (spending surged in 2024 by more than 20% to over $400bn) will be a factor in Chinese demand but there is consensus that the construction slump, particularly for completions, will continue to be a drag.

Getting the treatment treatment

The all-time low benchmark treatment charges of $21.25/t (the benchmark was $80/t last year and spot TCs even went negative for several months this year) agreed between Antofagasta and Jiangxi last week lifted spirits but as many have pointed out it’s a sign of smelter overcapacity not demand for concentrate.

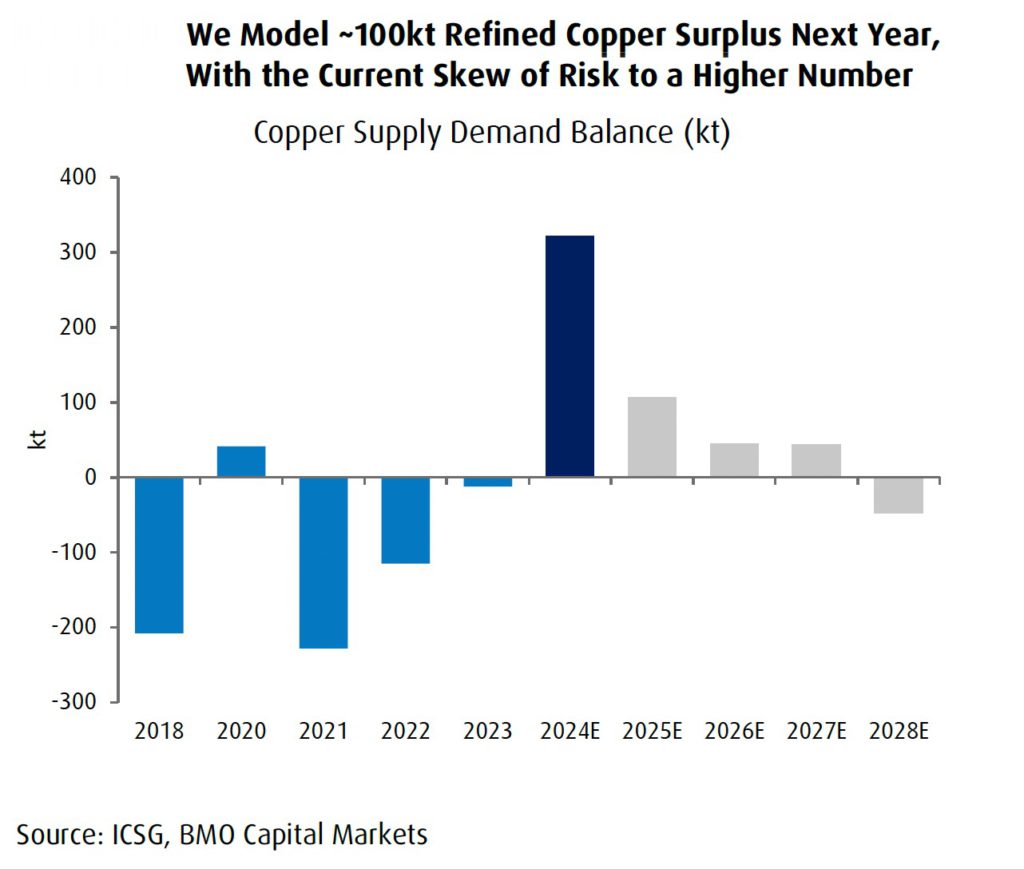

After promised supply cuts from Chinese refiners did not materialize 2024 turned out to be the largest (refined) copper surplus in over a decade. BMO predicts a much smaller surplus this year of around 100kt. RBC sees around half that while Macquarie is most pessimistic with a refined surplus three times BMO’s (but a deficit on concentrate markets).

Macquarie also points to the wild card for copper market over the next few years: “Should the Cobre Panama mine restart, and we believe it ultimately will, then there is the potential for an additional 300ktpa of mine supply which would keep the market in a comfortable surplus out to 2029 (all else being equal).”

The price is right?

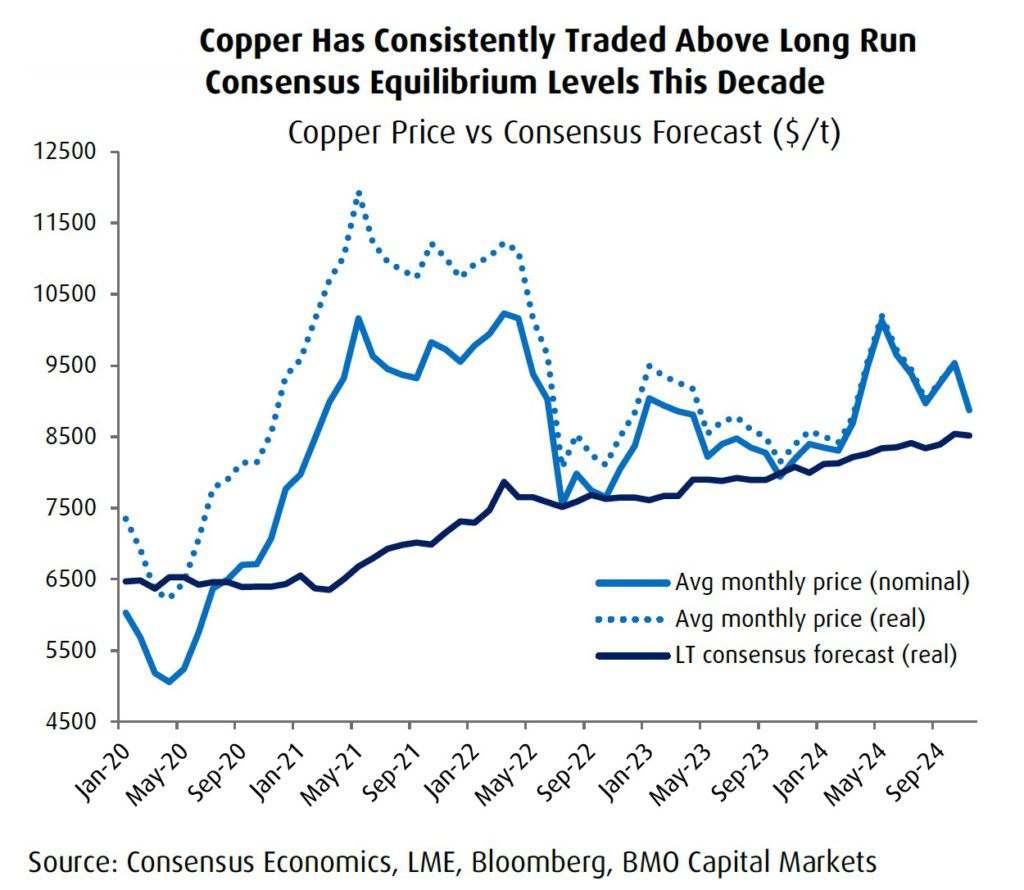

Goldman Sachs, the copper uber bulls of the last few years, took a chainsaw to its price forecast but even after cutting by $5,000 is still one of the more optimistic prognosticators. The investment bank sees copper averaging $10,160 a tonne next year.

Morgan Stanley forecasts prices will climb to $9,500 by the end of 2025. The Chile mining association is also one of the more sanguine at between $9,260–$9,920, but CitiGroup recently slashed its expectations from an average of $10,250 to $8,750 next year.

RBC lowered its 2025 estimate to $8,800 (from just under $10,000 before), while BMO’s prediction for next year is also for copper to camp out around the $4.00 or $8,800 level.

Capital Economics is the most pessimistic forecasting copper would lose touch with the $9,000 a tonne level next year, average only $8,000 by the end of 2026, and continue to drift lower through 2030.

StreetwiseReports.com: Never Ever Seen Better Outlook for Silver, Expert Says

Source: Streetwise Reports (10/30/24)

The silver price is expected to soar soon, during the current bullish precious metals market. We look at three junior mining companies that could stand to benefit.

The silver price is rising albeit with volatility, supply-demand is imbalanced and the outlook for the metal is bullish, according to the experts. Equities, mining juniors in particular, are a great way to play the silver market. In the words of Barry Dawes, executive chairman of Martin Place Securities, a “silver frenzy [is] coming,” he wrote on Oct. 23.

In its catching up to gold, the silver price recently broke through US$35 per ounce (US$35/oz), reflecting a year-to-date gain of about 47%. Since, the price fell back a bit to the US$34/oz range, but Brien Lundin, newsletter editor, encouraged investors not to get discouraged, as the drop-off is temporary. He expects the silver price to soar when the U.S. Federal Reserve doubles down on its efforts to get interest rates much lower, he wrote on Oct. 23.

Based on silver’s charts, Ron Struthers of Struthers Resource Stock Report also predicted a major run-up in the silver price.

“Back in April or early May, I highlighted the breakout from a cup and handle formation and [that] that would lead to a major upside move. This is now confirmed,” he wrote on Oct. 23.

Silver Demand on the Rise

Growing demand and an undersupply of the white metal are helping drive up its price. The Silver Investor’s Peter Krauth told Investing News Network (INN) that silver demand has exceeded annual supply since 2020, new mine supply peaked eight years ago, and overall supply has been flat for a decade. Krauth explained that these conditions have not led to an explosion of the silver price already because consumers have been able to “tap stockpiles of ‘secondary inventories’ at major futures exchanges and exchange-traded funds.” However, their ability to do this will end, likely within 12–18 months, when this specific supply dries up.

Meanwhile, worldwide demand for silver, valued as an industrial and a precious metal, is expected to increase 2% this year over last, to 1,200,000,000 ounces, yet supply is projected to drop 1%, according to The Silver Institute. This year, the global silver market is forecasted to face a deficit of 759,000,000 ounces (759 Moz), the equivalent of about three-fourths of one year’s supply, Money Metals reported Krauth saying in a recent presentation.

Most, or 61%, of silver demand is for industrial applications, including electrical, electronics, printing, plastics, and photography. Given its use in electric vehicles, photovoltaic panels, and batteries, silver is critical to the global green energy transition.

Demand for use in photovoltaic panels alone this year will be about 232 Moz, nearly three times the 80 Moz needed in 2020, according to The Silver Institute. TopCon cells are dominating the photovoltaics market, and they require 50% more silver. Rising demand for photovoltaics from India and the country’s reduction in the silver duty to 6% are further straining the metal’s supply, Krauth told INN.

The remaining 30% of total global silver demand breaks down like this: 17% for jewelry, 5% for silverware, and 17% for investments.

“Traders might consider [silver] to diversify their investment portfolios, valuing the possibility of using silver as a hedge during periods of uncertainty and high inflation,” Mind Money CEO Julia Khandoshko told INN. She added that strong geopolitical and economic issues are continuing to impact silver.

New applications of silver continue to be discovered, in biotech for example, according to The Pure Gold Co. As technology and the global economy evolve, so will silver’s industrial uses, Matt Watson, founder and president of Precious Metals Commodity Management, told Kitco News on Oct. 17. Expansion of the artificial intelligence industry will boost demand for silver, too, for use in energy storage, transportation, nanotechnology and more.

“[Silver] is the do-it-all metal on the Periodic Table,” Watson said. “I don’t see any fundamental downside to silver.”

Silver Price About To Take Off

Now is the time to invest in the silver market, experts say, because it is undervalued and the price is about to take off. Coeur Mining CEO Mitchell Krebs, for instance, told Kitco, “I have never seen a better outlook for silver. It’s an extremely exciting time to be in the silver market.”

All of the data are pointing to the same conclusion, that silver is about to have “an upward revision,” an Investing Haven article noted. The 50-year silver price chart is looking “insanely bullish” and the 20-year silver price chart is looking “very bullish.” The silver adjusted for Consumer Price Index metric is indicating that silver is “wildly undervalued,” and the increasing imbalance in supply and demand of the metal supports this.

In addition, silver’s hidden indicator, the silver miners to silver junior miners ratio, is breaking out after some years of consolidation, Investing Haven added. This is indicating that risk is on and confirming that “strong bullish momentum is about to hit the silver market.”

Silver juniors offer the greatest leverage to increasing commodity prices and the highest potential return, more so than silver senior/major and midtier miners Ahead of the Herd’s Richard Mills purported in a recent newsletter issue. Investing in a junior with an excellent project in a safe jurisdiction and led by a management team that can raise money “can reap huge rewards,” he wrote. “Five, 10, even 20 times your money isn’t uncommon.”

When silver moves, it does so quickly, Dominic Frisby pointed out in The Flying Frisby on Oct. 23.

“There is not a lot standing in the way of silver and US$50,” he wrote. “In that scenario, the miners will go to the moon. If it breaks above US$50, there is nothing but blue sky above.”

Krauth thinks the silver price could actually reach triple-triple digits, or US$300/oz, based on the technical and historical indicators, he said in an Oct. 8 video. “I don’t believe it will stay there, but I do think that it could be in our future.”

The bullish silver market and the rising silver price bode well for junior mining companies, including these three:

Dolly Varden

Headquartered in British Columbia, Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) is advancing its Kitsault Valley project, a combination of Dolly Varden and Homestake Ridge, in the province’s Golden Triangle.

Recently, the company raised another CA$4.5 million (CA$4.5M) via the second and last tranche of its bought deal financing, funds it will use on further exploration work, mineral resource expansion, and drilling at Kitsault Valley, a news release indicated. Total gross proceeds from the first and second tranches are CA$32.2M.

Haywood Securities in an Oct. 17 research note wrote, “Dolly Varden Silver offers investors exposure to both high-grade gold and high-grade silver at their Kitsault Valley. [The company] has expanded their current exploration program at Kitsault to 32,000 meters (32,000m) following encouraging initial results. We view Dolly as a potential mergers and acquisitions target, particularly in light of Hecla Mining Co.’s (HL:NYSE) [roughly] 15% ownership.”

According to Dolly Varden, 48% of the company is held by institutional investors, including Fidelity Management & Research Company LLC, Sprott Asset Management LP, U.S. Global Investors Inc., Delbrook, and Extract Capital.

About 44% is with strategic investors, including 19% with Fury Gold Mines, 15% with Hecla, and Eric Sprott owns 10% himself.

The rest, 8%, is with retail and high-net-worth investors.

Structurally, the company has 302.16M outstanding shares and 170.33M free float traded shares. Its market cap is CA$297.44M, and its 52-week range is CA$0.62–1.46 per share.

AbraSilver

AbraSilver Resource Corp. (ABRA: TSX.V; ABBRF:OTCQX), based in Toronto, Ontario, is advancing its Diablillos project in Argentina, where three rigs are currently drilling.

The latest results from the 2024, in-progress, 20,000m drill program were notable for exceptionally high grades, a news release indicated. They included 250 grams per ton (250 g/t) silver over 50m beyond the JAC zone and 496 g/t silver over 15m at the Oculto northeast area.

These high grades should help expand the existing mineral resource at targets with known mineralization, one of the current campaign’s two objectives. The other is drill testing newly identified prospective exploration targets within the broader Diablillos land package. Thus far, AbraSilver has completed 58 holes over about 11,560m.

AbraSilver is one of Jordan Roy-Byrne’s Top 12 precious metals stocks, and he rates it Buy. In The Daily Gold Premium on Sept. 25, he wrote the company’s stock “has some resistance but should start to eat up.” Since, the share price surpassed Roy-Byrne’s then-target on it.

Hallgarten & Co., which initiated coverage on AbraSilver in December 2023, has a target price on it today that reflects a 23.2% upside, according to a Sept. 9 research report.

Peter Krauth of the Silver Stock Investor also shared optimism in the stock in an October 28 article, where he wrote, “ABRA shares have remained solidly up this year and ahead 35% since being added to the portfolio in April. Attractive to add on weakness.”

As for ownership of AbraSilver, nine strategic entities own 2.7% or 4.31M shares, according to Refinitiv. The Top 3, all insiders, are Chief Executive Officer (CEO) John Miniotis with 0.19% or 1.09M shares, Director Hernan Zaballa with 0.86% or 1.08M shares, and Chairman and Director Robert Bruggeman with 0.74% or 0.93M shares.

Nine institutions hold 6.84% or 8.58M shares. The Top 3 are Mirae Asset Global Investments (USA) LLC with 2.1% or 2.63M shares, ETF Managers Group LLC with 1.74% or 2.18M shares, and Sprott Asset Management LP with 1.2% or 1.51M shares.

Retail investors own the remaining 90.46% of AbraSilver.

The company has 125.4M outstanding shares and 121.09M free float traded shares. Its market cap is CA$282.28M. Its 52-week high and low are CA$3.18 and CA$1.30 per share, respectively.

Kuya Silver

Also headquartered in Ontario, Kuya Silver Corp. (KUYA:CSE: KUYAF:OTCQB) has two district-scale silver projects.

At its Bethania mine in central Peru, which restarted in May, the company is producing a silver-lead-zinc concentrate. Kuya just sold and shipped its first batch of concentrate, thereby derisking the entire process, from start to finish or mining to delivery, as noted in a news release.

The systems at Bethania are ready for full-scale production, and the company continues to ramp it up. It also continues to stockpile mineralized material at the mine site for transport to the mill.

Kuya is advancing its second project, Silver Kings, in Ontario’s most prolific mining camp near Cobalt. The plan is to conduct a 10,000m-plus follow-up drill program in the Campbell-Crawford area to expand on recent discoveries and drill new targets, according to the September 2024 Investor Presentation.

Jay Taylor of Gold, Energy & Tech Stocks wrote this about Kuya on Sept. 30: “While I am hopeful that plans to expand and grow the company with the Bethania operation succeed, my real excitement for Kuya stems from its Silver Kings project in Ontario, where on April 4, 2023, Kuya announced phenomenal assays from the second of two holes. The headline was an amazing 494.2 ounces of silver over 3.04m. This was the highest intersection ever drilled in the camp.”

According to Refinitiv, four insiders own 10.53%, or 11.08M shares, of Kuya Silver. They are President, CEO, and Director David Stein with 9.53% or 10.13M shares, Chief Operating Officer Christian Aramayo with 0.56% or 0.6M shares, Vice President of Corporate Development Tyson King with 0.27% or 0.29M shares and Board Chair Heather Lendon with 0.06% or 0.06M shares.

Two institutions hold 8.61% or 9.06M shares. They are Crescat Capital with 8.39% or 8.92M shares and Incrementum AG with 0.13% or 0.13M shares.

The remaining 80.86% of Kuya is in retail.

The company has 106.38M outstanding shares and 94.12M free float traded shares. Its market cap is CA$30.76M, and its 52-week range is CA$0.195–0.46 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Gold-Eagle: Gold Forecast: Expecting New Highs and a Powerful Rally into August

https://www.gold-eagle.com/article/gold-forecast-expecting-new-highs-and-powerful-rally-august

Gold, silver, and platinum closed above the prior week’s highs, and I see the potential for cycle lows.

Miners gapped through their respective 50-day EMAs on Thursday, and one more strong up-day would establish a bottom.

If the June lows are in, as predicted, then we should be starting the next up leg, which could lead to significant price spikes into August.

GOLD– Gold is very close to confirming a June cycle low. We expect new all-time highs in July and see the potential for a price spike towards $2800 in August.

SILVER– Silver needs progressive closes above $31.00 to establish its cycle low. Once prices rise above $33.00, expect fireworks.

GDX– Miners gapped through the 50-day EMA, and I see the potential for a cycle low; as long as prices don`t close below the $33.70 price gap.

GDXJ– As long as junior miners don`t close below the $42.20 price gap, I see the potential for a June low.

SILJ– Silver juniors would have to close below $11.50 to reduce the potential for a cycle low. Otherwise, it looks like prices bottomed.

NEM WEEKLY– Newmont may have reached a generational low below $30.00.

Margins and productivity are returning (after the painful Newcrest acquisition), and profitability could expand significantly with higher gold.

It’s hard to say how high prices could go, but I believe it will be multiples higher from here.

Conclusion

Metals and miners are very close to completing cycle lows. From here, we expect an aggressive rally into August, with the potential for gold to reach $2800.

********

Mining.com: More central banks to increase gold reserves within 12 months, WGC survey finds

More central banks plan to add to their gold reserves within a year and more of them expect others to do so as well, due to ongoing macroeconomic and political uncertainty despite high prices for the precious metal, the World Gold Council (WGC) said in its annual survey.

Demand for gold from central banks has been elevated in the last two years as some countries diversify their foreign currency reserves. Their demand contributed to the gold price rally in March-May with the spot price hitting a record high of $2,449.89 per ounce on May 20.

SIGN UP FOR THE PRECIOUS METALS DIGEST

“Despite record demand from the official sector in the last two years, coupled with climbing gold prices, many reserve managers still maintain their enthusiasm for gold,” Shaokai Fan, WGC head of central banks sector, said in a statement.

The survey, which was conducted in February-April and included a total of 69 responses, showed that 29% of central banks expected their own gold reserves to increase in the next 12 months.

This is the highest level since the WGC, an industry body whose members are global gold miners, began the survey in 2018 and compares with 24% in 2023.

The WGC said 81% of respondents expected global central bank gold reserves to increase over the next 12 months compared with 71% a year ago.

While in prior years, gold’s “historical position” was the top reason for central banks to hold gold, this factor dropped to fifth among WGC survey responses this year.

The top reasons given for the increases now are “long-term store of value or inflation hedge,” “performance during times of crisis” and “effective portfolio diversifier.”

Some 41% of 58 respondents listed domestic storage as the vaults where their gold reserves are kept, compared with 35% in 2023. However, the Bank of England remains the most popular location listed in 55% of the responses.

Among 57 respondents, 15% said they planned to change custody arrangements for their gold in some way in the next year compared with 6% in 2023. This includes diversifying the overseas storage as well as an increase or decrease of the domestic storage.

(By Polina Devitt; Editing by Bill Berkrot)

Kitco.com: The world is going to need more gold

https://kitco.com/news/article/2024-06-14/world-going-need-more-gold

(Kitco News) – Last week, we warned investors that gold’s selloff was an overreaction to misunderstood fundamental news.

Blackbox (algorithmic trading) gold traders, who have been relying on Chinese central bank buying, were spooked when data from the People’s Bank of China showed that it didn’t increase its reserves last month, ending an 18-month shopping spree.

Gold managed to hold critical support at $2,300 on Monday and is seeing a 1% gain on the week heading into the weekend.

This week, I attended the 30th annual Montreal Conference of the International Economic Forum of the Americas, which helped me better understand the growing trend of deglobalization.

“It’s extraordinary to me to see how rapidly we’ve moved from a situation where globalization seemed inevitable to where today it increasingly seems impossible,” said Perrin Beatty, a former Progressive Conservative Cabinet Minister and President and CEO of the Canadian Chamber of Commerce, during a panel discussion.

While the U.S. dollar is expected to remain the world’s reserve currency, it will face growing competition.

Analysts constantly reiterate that gold will play a growing role in a multipolar currency world because it remains one of the most liquid monetary assets in global financial markets.

We can already see the U.S. dollar’s diminished role on the world stage. This week, the trade agreement between the U.S. and Saudi Arabia, which established the petrodollar, was allowed to expire.

For the past 50 years, the U.S. dollar has dominated global trade as the two nations agreed to price oil in U.S. dollars. This agreement cemented the dollar as the world’s reserve currency and ushered in an era of prosperity for Americans; in exchange, the U.S. provided military support and protection to the kingdom.

Saudi Arabia’s moves to expand beyond the USD come as it enters a new trading bloc with expanded BRICS nations: Brazil, Russia, India, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates.

During the Montreal conference, Ali Borhani, Managing Director of 3Sixty Strategic Advisors Ltd and co-founder and host of the BRI Dialogues, put the expanded trading bloc into perspective and noted that people have to recognize that the world has changed.

“Half of the world population is in BRICS+. Two-thirds of world trade happens in BRICS+. BRICS are adding 74 million consumers a year. That is two times Canada out of these markets,” Borhani said during the panel discussion.

“The largest buyers of energy and the largest sellers of energy happen to be in the Global South and among BRICS. So we’re looking at the rewiring of energy, finance, supply chain, and tech.”

Because of these broad-reaching geopolitical shifts, it is fairly easy to make a simple case for gold as a global currency. Many analysts have noted that gold remains the best neutral asset to settle trade imbalances.

So it’s not just China that is going to have to buy more gold; nations around the world, especially those in emerging markets that have relied so heavily on the U.S. dollar, will have to rebuild their gold reserves.

That is it for this week. Have a great weekend.

Neils Christensen

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada.

Mining.com: Copper price hits record above $11,000 on bets that shortage looms

https://www.mining.com/web/copper-price-hits-record-above-11000-on-bets-that-shortage-looms/

Copper surged to its highest-ever level, extending a months-long rally driven by financial investors who’ve piled into the market in anticipation of deepening supply shortages.

Futures on the London Metal Exchange jumped more than 4%, taking copper past $11,000 a ton for the first time, before paring some gains in afternoon trading.

SIGN UP FOR THE COPPER DIGEST

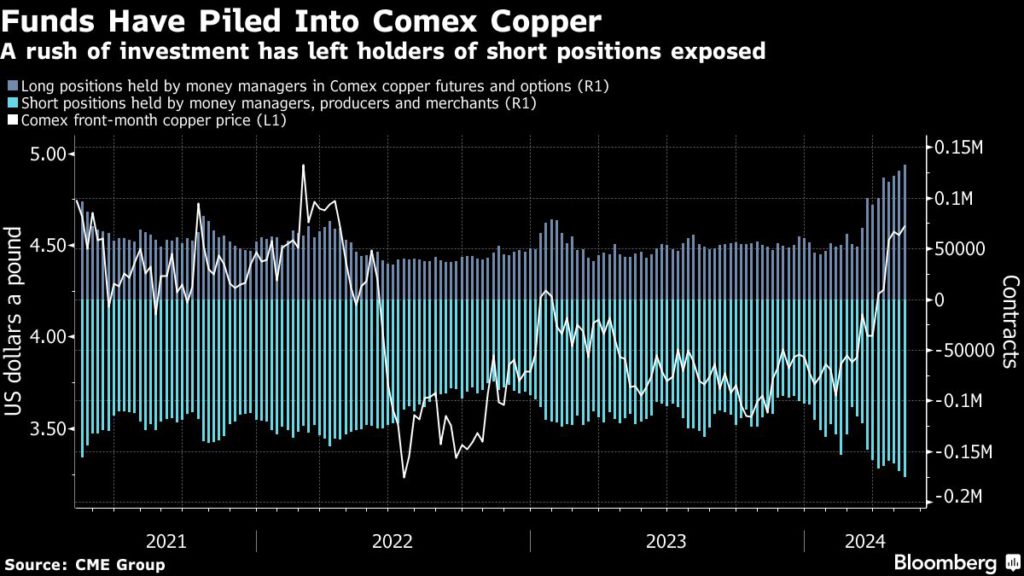

Banks, miners and investment funds have been touting copper’s bright long-term prospects for months, and a flood of investment into the market over the past few weeks has piled pressure on bearish traders who’ve taken a more cautious stance owing to weak spot demand, particularly in China.

Several developments in 2024 have emboldened copper bulls and drawn in a rising tide of speculative money. Tight supply of copper ore fueled talk of output cuts by smelters, and investors are betting that surging usage in fast-growing sectors including EVs, renewable energy and artificial intelligence will offset the drag from traditional sectors like construction.

Prices started to take off in early April, and last week the rally went into overdrive as a short squeeze on the New York futures market triggered a global rush to secure the metal.

“That has taken prices to another level and it’s very difficult to call a top in this environment,” Craig Lang, principal analyst at researcher CRU Group, said by phone from Singapore. “Commodities markets do tend to overshoot.”

Investors, traders and mining executives have warned for years that the world faced a critical shortfall of copper amid ballooning demand in green industries. Jeff Currie, commodities veteran and the chief strategy officer of the energy pathways team at Carlyle Group Inc., said last week that copper was the best long trade he has ever seen.

However, many participants in the physical trade have warned that copper prices were running ahead of reality. Demand remains relatively tepid — especially in top buyer China, where inventory levels remain high and suppliers of copper wires and bars have been cutting output. Chinese demand is so subdued that smelters have been racing to export copper as prices in New York and London have shot ahead of prevailing prices in the domestic market.

But the disconnect has continued to grow as investors flocked to western exchanges and bearish traders rushed to buy back short positions.

Copper’s rapid ascent to $11,000 has also brought significant volumes of bullish options into the money, in a trend that could add fuel to the rally as dealers who’ve sold the contracts move to cover their exposure by buying futures.

LME copper was up 2.2% to $10,904 a ton by 3:15 p.m. in London, after earlier hitting an all-time peak of $11,104.50 a ton.

Prices have gained more than a quarter since the start of this year, spearheading across-the-board gains for major industrial metals. Like copper, gold has also rallied to a record, with both metals getting support from optimism that the US Federal Reserve will start cutting interest rates this year.

Diverted metal

A series of setbacks at major copper mines are fueling fears that a much-anticipated production shortfall will arrive earlier than expected. Smelter treatment fees — a gauge of tightness in the ore market — plunged below zero in April, raising the prospect that plants will be forced to cut production to stem losses.

And the short squeeze on the Comex exchange in New York drove prices there to an unprecedented premium over the LME. That triggered a rush to reroute copper to the US, meaning less metal available elsewhere.

“The Comex short squeeze is rediverting copper to the US and tightening supplies in other regions,” Gong Ming, an analyst with Jinrui Futures Co., said by phone. “The Chinese market is expected to see inventories withdrawal soon with exports rising.”