Mining.com – Goldman flags record gold price, weak oil in 2026 commodity picks

Mining.com – Goldman flags record gold price, weak oil in 2026 commodity picks

https://www.mining.com/web/goldman-flags-record-gold-weak-oil-in-2026-commodity-picks/

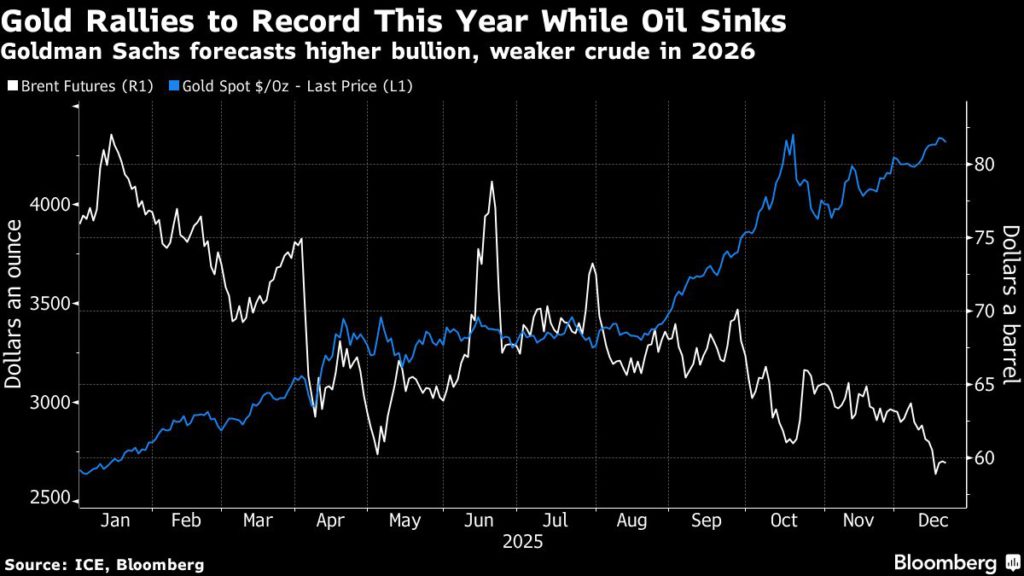

Gold’s record-setting rally and persistent weakness in crude have been two of the standout features of global commodities this year. Goldman Sachs Group Inc. reckons both those trends will extend into 2026.

Bullion is set to hit a fresh record next year, while oil will be burdened by a surplus, analysts including Daan Struyven and Samantha Dart said in a Dec. 18 note that set out the bank’s main picks in raw materials. The base case for gold is a rally to $4,900 an ounce, with risks to the upside.

Commodities as a whole are on course for a modest advance this year, but the sector’s climb masks huge variations in the underlying performances of heavyweight materials. While gold has risen on central-bank buying, interest-rate cuts from the US Federal Reserve, and inflows to exchange-traded funds, crude has been hurt by widespread concerns about a huge glut.

Falling US interest rates have led ETF investors “to start competing for limited bullion with central banks,” the analysts wrote. “We expect the same two drivers — structurally high central-bank demand and cyclical support from Fed cuts — to lift the gold price further.”

By contrast, oil faces downside risks, they wrote. “Barring large supply disruptions or OPEC production cuts, lower oil prices in 2026 will likely be required to rebalance the market,” they said. “We expect the 2026 surplus to lead to an acceleration in OECD commercial stocks builds.”

Global crude benchmark Brent is expected to average $56 a barrel next year, with West Texas Intermediate at $52, they said.

On Friday, Brent traded below $60 a barrel, set for a second weekly loss despite geopolitical tensions in Venezuela that have fanned concerns about possible interruptions to supplies. Gold was near $4,323 an ounce.

Among other forecasts, Goldman Sachs flagged lower natural-gas prices on the “largest ever wave” of supply; that copper would outperform aluminum; and weaker iron ore amid burgeoning mine production.

(By Jake Lloyd-Smith)