MetalsNews Interview: CEO Frank Basa Outlines Plans for Re-Drilling the Granada Gold Deposit to Develop It as a High-Grade Resource

MetalsNews Interview: CEO Frank Basa Outlines Plans for Re-Drilling the Granada Gold Deposit to Develop It as a High-Grade Resource

| Granada Gold Mine Inc.: Exploring and Developing a High-Grade Open-Pit and Underground Gold Deposit, on the Prolific Cadillac Trend, in Quebec’s Abitibi Region; Interview with Frank J. Basa, President, CEO, and Chairman |

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/18/2020

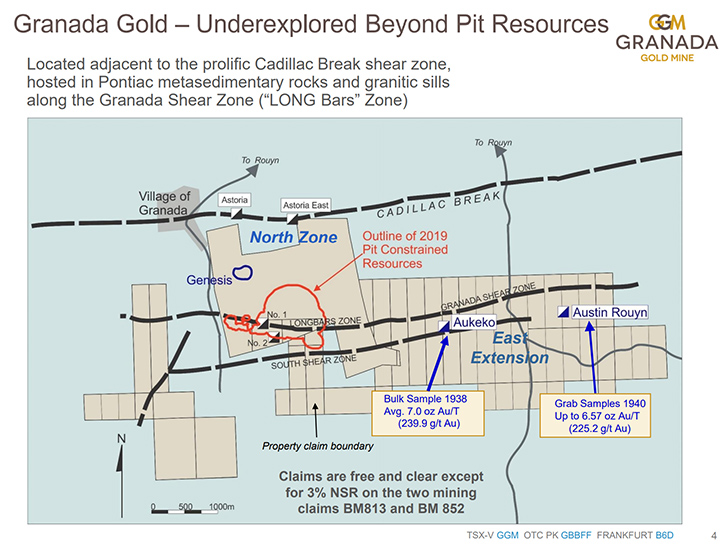

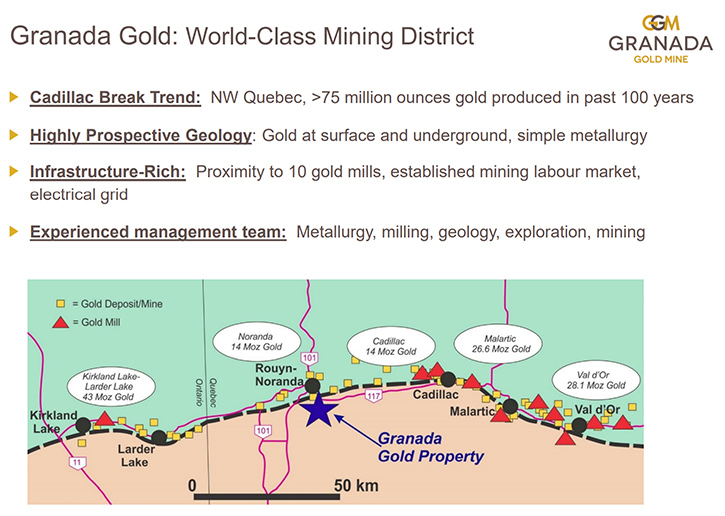

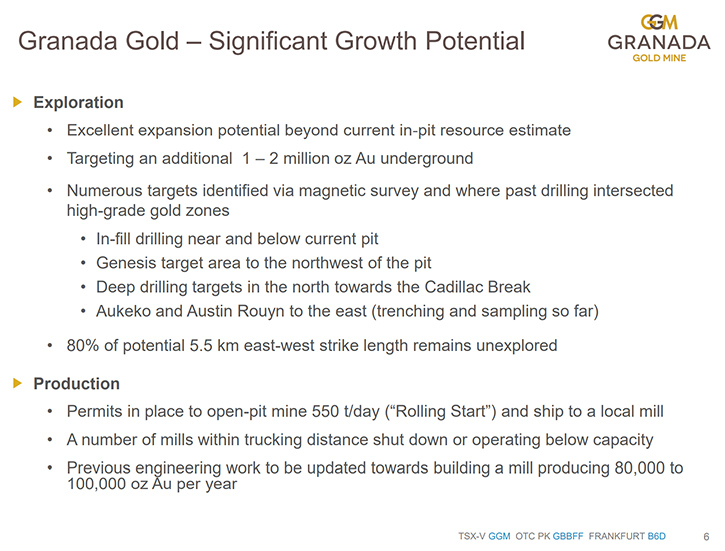

Granada Gold Mine Inc. (TSXV GGM) continues to develop the Granada Gold Property, located near Rouyn-Noranda, Quebec, the premier exploration and development project, on the prolific Cadillac Trend, in Quebec’s Abitibi region. We learned from Frank J. Basa, President, CEO, and Chairman of Granada Gold Mine that in 2020 they have been re-drilling the Granada Gold Property, to develop it as a high-grade resource, by restructuring the low-grade open-pit into a combined high-grade open-pit and underground mine, targeting a total 2.5-3 million gold ounces between them. Near-term plans include completing a total of 120,000 meters of drilling over 24 months to achieve that goal.

Granada Gold Mine Inc. (TSXV GGM): Exploring and Developing a High-Grade Open-Pit and Underground Gold Deposit, on the Prolific Cadillac Trend, in Quebec’s Abitibi Region; Interview with Frank J. Basa, President, CEO, and Chairman |

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/18/2020

Granada Gold Mine Inc. (TSXV GGM) continues to develop the Granada Gold Property, located near Rouyn-Noranda, Quebec, the premier exploration and development project, on the prolific Cadillac Trend, in Quebec’s Abitibi region. We learned from Frank J. Basa, President, CEO, and Chairman of Granada Gold Mine that in 2020 they have been re-drilling the Granada Gold Property, to develop it as a high-grade resource, by restructuring the low-grade open-pit into a combined high-grade open-pit and underground mine, targeting a total 2.5-3 million gold ounces between them. Near-term plans include completing a total of 120,000 meters of drilling over 24 months to achieve that goal.

Granada Gold Mine Inc. native gold found in surface material during bulk sampling

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Frank J. Basa, who is President, CEO, and Chairman of Granada Gold Mine. Frank, could you give our readers/investors an overview of your Company? What differentiates your Company and what are some of the new things that have happened in 2020?

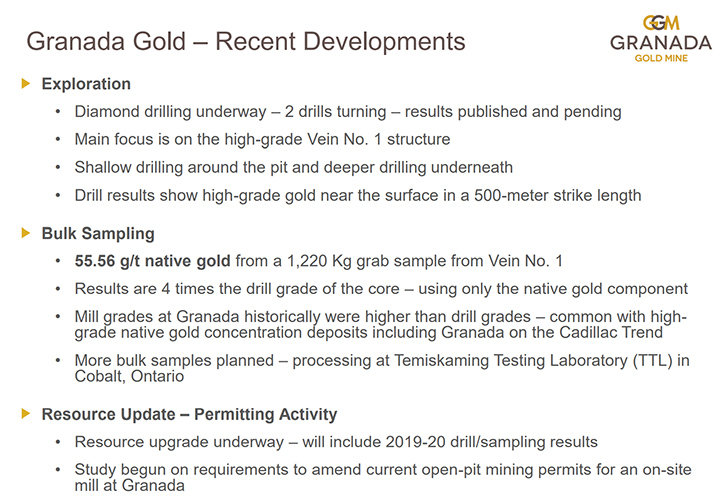

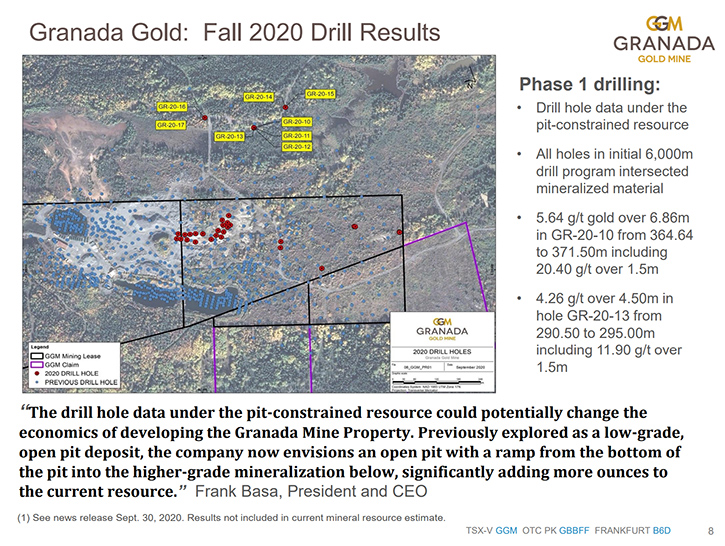

Frank J Basa: Well, thank you very much, Allen, for having us here. We’re re-drilling our property to develop it as a high-grade property, upgrading it from a low-grade open pit. We looked at the economics and the economics look better to have it as a high-grade resource. What we are working towards is to have open-pittable grades somewhere between three to five grams per tonne, with underground at about four to five grams per tonne. We’re targeting to have about two-and-a-half, 3 million ounces between the open pit and underground. The open pit is expected to have about 300,000 ounces and the rest underground.

We started drilling a little later than everybody else and our undervalued market cap reflects that. We finally got our drills onsite in the second quarter of this year. And we now have two drills, drilling around the clock. One is working on near surface targets, and the other’s drilling deeper below the open pit. The open pit that we have now in our 43-101 resource report is a lower-grade one, grading about 1.0 gram per tonne, with about 1.2 million ounces, and we are working to restructure that.

So, we’re expecting to complete 120,000 meters of drilling over a total of 24 months. Hopefully, by the time we’ve completed that, there’ll be a few resource re-calculations along the way and our final resource numbers are targeted to be somewhere around two-and-a-half to 3 million ounces.

One thing that makes us more-advanced, compared with other exploration companies in the Abitibi, is that we’re fully permitted now as a shipper. We can open-pit mine areas at the surface and ship for processing at a local mill. The permits for that took us about two years to get, and $6 million worth of studies. We are shovel-ready right now, if somebody wants to take our rock. The ideal thing, in order to make this more attractive for shipping, is to develop the resource as we’re attempting to do at three to five grams open pittable and then underground somewhere from four to five grams per tonne.

Dr. Allen Alper: That sounds excellent. What are your chief goals going forward into 2021?

Frank J Basa: In 2021 and 2022, we’ll do the remainder of that 120,000 meters of drilling (almost 12,000 meters are drilled already). That should give us our resource that we’re targeting at two-and-a-half million, 3 million ounces, between open pit and underground.

Dr. Allen Alper: Could you tell our readers/investors more about the data you found on your property?

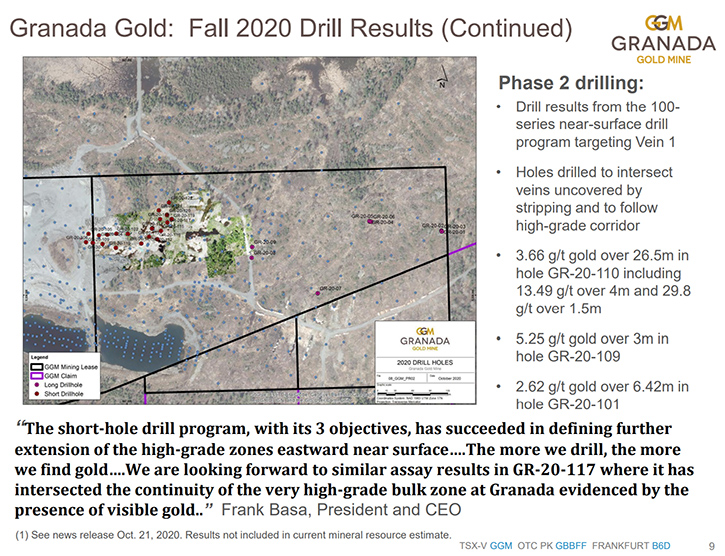

Frank J Basa: There are 9 to 22 veins going east to west, in a structure that’s 350 meters thick. We started in 2018, testing a revised drilling program. We only focused on three veins, which were historically mined. For example, vein number one was mined underground at 9.7 grams per tonne and open pit was at three-and-a-half to five. We’re focusing on vein number one right now. We’ll also focus on vein number two, and then the other one. So, we’re only going to work with three veins and those three veins hopefully will give us our targeted resource.

So far, drilling on surface, we actually exceeded at times our grade objectives – sometimes you have even higher grades than the five grams. We’re also doing some larger grab(bulk) samples on surface, to quantify those grades a little better. Drilling under the pit, we’d been hitting the four to five grams target, sometimes a little higher. We’re only targeting about 1.4 meters at width, but we’ve gotten up to six meters at width in these structures. So, we still have a lot to explore. Even after we drill off that two-and-a-half to 3 million ounces, we’re only 20% explored over our property.

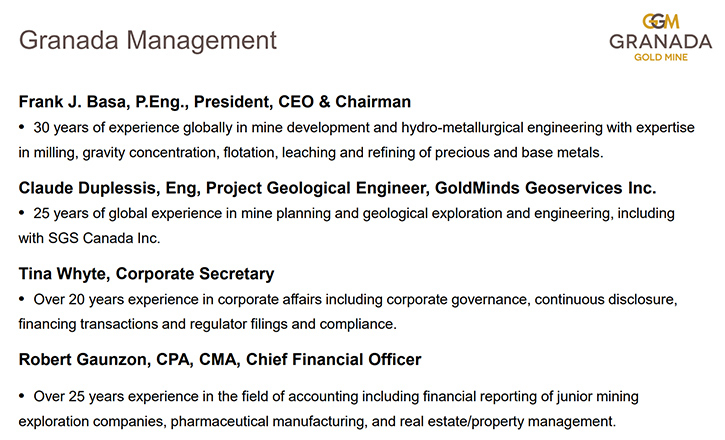

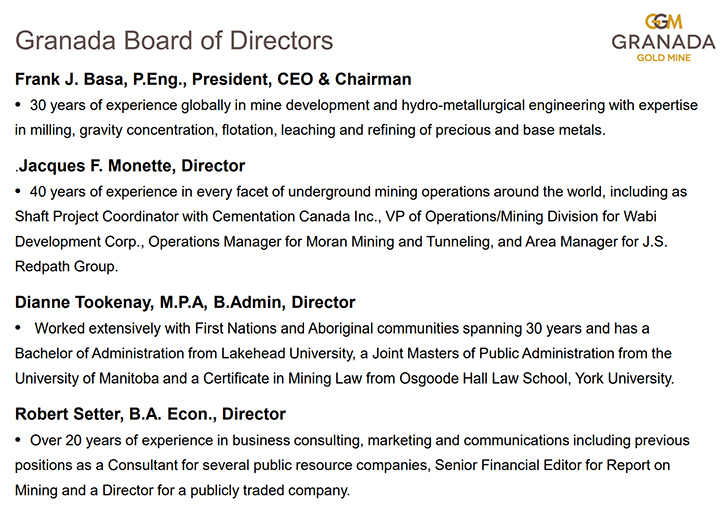

Dr. Allen Alper: Oh, that sounds like an excellent opportunity for a discovery, as you drill more. Sounds like 2021 will be a very exciting time for your shareholders and stakeholders. Could you tell our readers/investors a little bit more about your background and your team?

Frank J Basa: We’re a group of mining professionals who worked all over the world for majors and juniors for 30, 40 years. We’ve decided to take over distressed assets. They’re former producers and we apply more modern exploration techniques. Hopefully, by developing these properties, they become marketable. We chose this property on the Cadillac Break. There are 12 mills in the area. Six of them are shut down right now because they have no rock.

We had three majors already on our property last year. They’re eagerly awaiting this revised higher-grade resource. Hopefully, one of them will step up, something like the deal whereby Monarch Gold was recently purchased by Yamana for $200 million. And that was a 2-million-plus underground deposit grading, I think, about 2.2 grams a tonne. So, Monarch got taken out for a good price and hopefully, given we only have at this time an $18 million market cap, in a two-year timeframe, our market cap might exceed a hundred million dollars, which we’ve done before in the past with this property. And hopefully it will be taken out by one of the majors in the area.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about the region you’re in and how important it is?

Frank J Basa: We’re on the Cadillac Break. Any deposit on the Cadillac Break always ends up being a multi-million-ounce deposit. In our area, over 70 million ounces of gold have been taken out of the ground. The structure starts in Quebec, it goes through Ontario, ends up in Northern Manitoba and then goes over a few hundred miles. There are all kinds of mines along the Cadillac Break. Of course, we’re on there as well. It’s the best address to have in Canada.

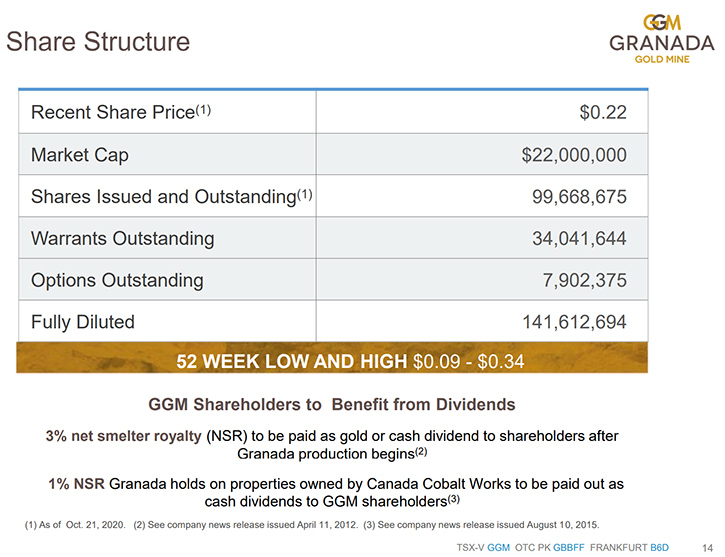

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Frank J Basa: We have about a hundred million shares outstanding. There are no major players in our Company. We, as Directors, have control of about 18%, so it’s relatively tightly held. We’re only trading about 18 cents Canadian right now, giving us a market cap of only about $18 million. We had it up to $33 million earlier this year. If the price of gold stays where it is now and then keeps on going up, of course we feel that our stock price will go up as well.

Dr. Allen Alper: Well, that sounds excellent! Could you tell our readers/investors the primary reasons they should consider investing in Granada Gold Mine?

Frank J Basa: Well, the thing is, we are probably the lowest value market cap in the Abitibi region, with the most ideal property. The dollar value for our gold in the ground is only US$12 an ounce at present. Most of the companies are being taken out at a value of between $60 and $120 an ounce. So, we feel, with our drilling and our capabilities, we will be able to increase our shareholder value. It’s a wonderful property. It’s fully permitted for open-pit mining. It’s one of the few fully permitted, if not the only fully permitted property, that could ship rock to anywhere in the area, currently.

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your permitting status?

Frank J Basa: We have 26 permits and we’re fully permitted to ship to a local mill. We didn’t want to build our own mill. We did a PEA to see what it would cost to build a mill and it came in at about $300 million. So, we thought, why build a mill when there are 12 mills in the area and a good number of them are shut down because they have no rock. That’s when we started working on the permits for mining and shipping to a local mill. We’re fairly confident that one of the three majors in the area will knock on our door, within our three-year timeframe, and take us out.

Dr. Allen Alper: That sounds very good. Is there anything else you’d like to add Frank?

Frank J Basa: We’re doing a simple, straightforward exploration program. We’re fairly confident we’ll get those ounces we are targeting. We’re pretty conservative in our approach. Of course, when there are six mills shut down, somebody will knock on our door. We’re only looking for a paper-for-paper transaction. So, we’re fairly confident. We’ve already had three offers in past years and we declined them, because we thought we could do better, with our stock price.

Dr. Allen Alper: Well, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.granadagoldmine.com/

Frank J. Basa, P. Eng.

President and CEO

1-819-797-4144

Wayne Cheveldayoff

Corporate Communications

416-710-2410

[email protected]