MetalsNews Interview – Bringing Magnesium Production Back into the USA

MetalsNews Interview – Bringing Magnesium Production Back into the USA

VANCOUVER, BC – Corporate Announcement – August 28, 2020 – Western Magnesium Corporation (TSXV:WMG; Frankfurt-M1V; OTCQB:MLYF) (“Western Magnesium” or the “Company”) would like to report that Executive President & CEO, Mr. Sam Ataya and Sr. VP of Operations, Mr. Paul Sauve, were interviewed by Dr. Allen Alper of MetalsNews. This featured article provides a comprehensive overview to define and distinguish the unique elements of Western Magnesium. Dr. Alper also brought front and center key deliverables as well as production milestones that will drive & produce shareholder value.

Western Magnesium would like to thank Dr. Alper for this opportunity and the work he has done to construct this timely editorial piece. The article can be accessed by clicking here.

| Western Magnesium Corporation (TSXV: WMG; Frankfurt-M1V; OTCQB: MLYF): Bringing Magnesium Production Back into the USA; Interview with Sam Ataya, Executive President, CEO and Paul Sauve, VP of Operations |

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/17/2020

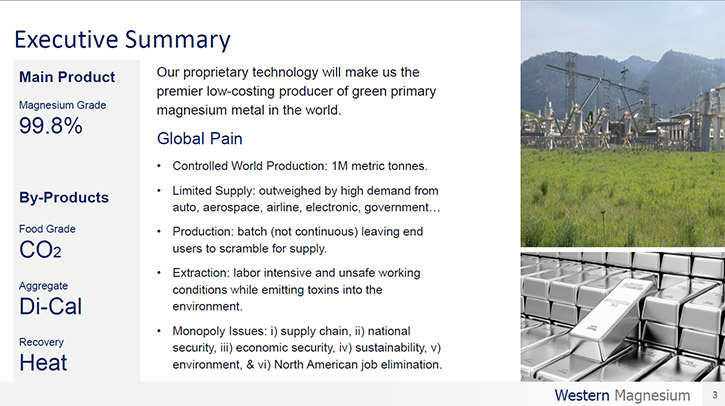

Western Magnesium Corporation (TSXV: WMG; Frankfurt-M1V; OTCQB: MLYF) plans to be a low-cost producer of green, primary magnesium metal, a strategic commodity prized for its strength and lightweight qualities, using a new environmentally friendly, cost and energy efficient technology, called continuous silicothermic process. We learned from Sam Ataya, Executive President, CEO and Director of Western Magnesium, and from Paul Sauve, the Company’s Vice President of Operations that the Company’s focus is bringing magnesium production back into the United States, targeting industries, such as the auto, aerospace, airline, electric car batteries, US government and the DOD. We learned from Mr. Ataya and Mr. Sauve that their proprietary technology is scalable, and price competitive with the world’s largest magnesium producer, China. Currently, Western Magnesium is building an advanced commercial pilot plant in British Columbia, scheduled to be completed by the end of 2020, and produce metal by first quarter of 2021.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Ataya, who is Executive President, CEO and Director, of Western Magnesium Corporation and also Paul Sauve, who’s Vice President of Operations of Western Magnesium. Sam, could you give our readers/investors an overview of your Company, and what differentiates your Company from others, and your vision for the Company?

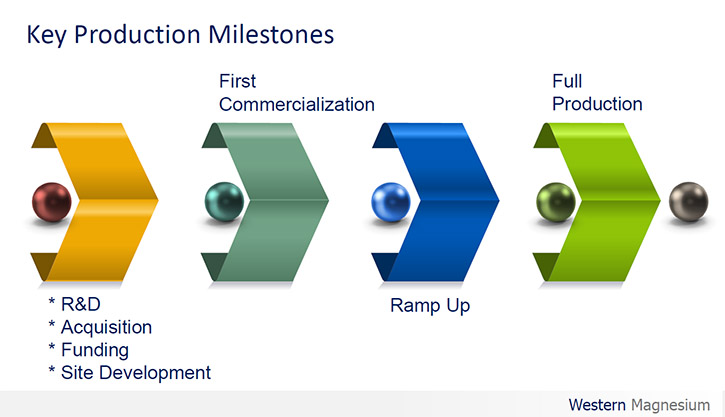

Sam Ataya: Absolutely. Thank you for that. The Company started nine years ago in an R&D state. We gathered a group of scientists and engineers, who were subject matter experts in magnesium production, for the purpose of bringing magnesium production back into North America, specifically into the United States, targeting industries such as the auto, aerospace, airline, eco-friendly technologies such as car batteries, US government and the US military, the DOD (Department of Defense). The target and focus still remains the same today. It is the United States and the industries in the United States. About three years ago, we proved concept on the production of magnesium metal in three areas that were very, very important to us. Number One, we had to be priced competitively with the largest producer of magnesium in the world today, which is China.

There are one million metric tons of magnesium metal being produced per year. That’s it! 85% or 850,000 metric tons are produced by the Chinese. And so we felt that we had to be price competitive with the largest producer, which I’m happy to say that we are. Number two, the technology had to be scalable, and today the technology is not scalable. So you either build a bigger plant, or you don’t. For us, we’re able to build a small plant in a rural area or a big commercialized plant in the middle of a downtown like Detroit, for example, servicing the auto industry. And third, and this is the most important, because of EPA requirements, not only in North America, the United States, Canada, or Europe, or even globally, EPA standards have really been a focus for us because that third area that we really had to prove concept in, was we want it to be zero waste and close to if not zero toxicity in our process.

And I’m very proud to say that we are, and we’ve been able to prove concept on that as well. Those were the three conditions we had to meet, and two and a half, almost three years ago, we proved concept on those three issues and we went from an R&D state, into an operational state. Since that time, we’ve been growing, not only our technological side and our development there, but also our corporate side. We are the only publicly traded company in North America, and there’s really only two publicly traded companies in the world, excluding ones that are Chinese that might be state owned. If we’re talking about free market, then there’s really only two, but in North America, there’s only us. And that’s something that we’re very focused on because transparency is very important, especially in dealing with big industry, and I think big industry really likes that when it comes to us. I hope that gives you an overview of where we’ve been.

Dr. Allen Alper: That sounds great. Maybe you could tell our readers/investors, refresh their memories about the magnesium market and their choices, and why it’s so critical.

Sam Ataya: Absolutely. So for this question, I’d like Paul, who is heading our technology development to address that question.

Paul Sauvé: Sure. Magnesium is 75% lighter than steel, and just as strong. It has one of the highest strength to weight ratios of all the elements. So it has a vast benefit for achieving fuel efficiency in vehicles and planes, and the lighter a vehicle is, obviously, the more fuel efficient it will be. So due to the density properties of it, it’s very beneficial as a structural metal. It’s used as an alloy, it’s never, or very rarely used as pure magnesium, but it’s mixed with things like aluminum and other metals to make a very strong, highly machinable and castable alloy that can replace things like pure aluminum and/or stainless steel in cars and planes. It is also now being used in military, quite substantially, and in things like SpaceX, rockets, satellites, due to that strength to weight ratio, it also has a highly dampening effect, which can be very beneficial in some industries.

It’s also being used in structural building materials, not so much in North America at this time, but that could change if a Company like ours comes online and produces magnesium at a consistent and stable rate, within North America. But in other parts of the world, primarily China, they’re starting to use magnesium alloys in replacement of structural steel. The lighter a material is, the taller you can build it. So it has a lot of opportunities to replace more friatec metals that are heavier just due to their properties. That’s the benefit of magnesium. The difficulty was the processing techniques were not there that made it attractive to produce, in modern ways, under modern EPA rules. And that’s where we come in.

Dr. Allen Alper: Well, that sounds excellent. Paul, could you give our readers/investors a more detailed description of your process, without saying anything proprietary?

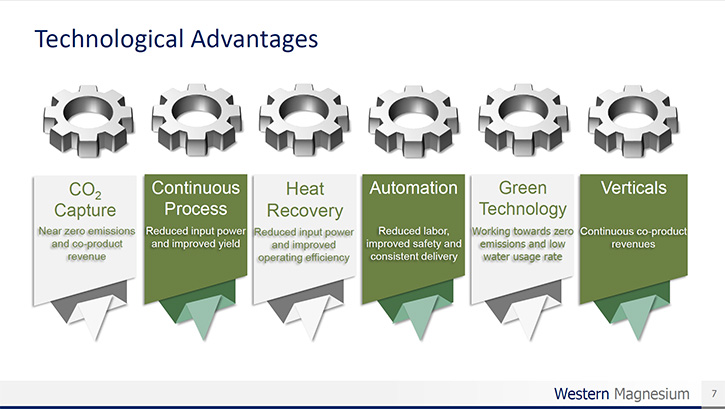

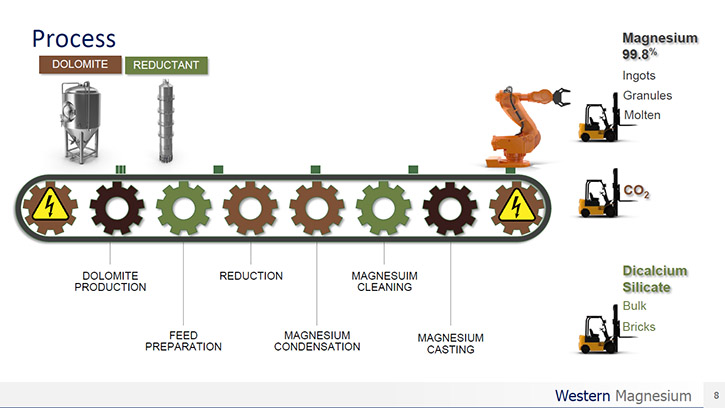

Paul Sauvé: Yeah. The easiest word to use that differentiates us is continuous. So the traditional method used to produce magnesium in China is something called the Pidgeon process, which is batch, highly labor-intensive. It has a lot of pollution issues and it’s just hazardous to people in the environment for lots of reasons. Our process has very similar chemistry, but it’s continuous and it’s extremely more efficient, due to the technological advancements we’ve made and the materials that we use. I won’t say any more than that, but its continuous nature is what makes our process so much more efficient and so much safer.

Dr. Allen Alper: Now, what kind of feed materials would you be thinking of using?

Paul Sauvé: At this time we’re focusing on dolomite.

Dr. Allen Alper: That sounds very good. Could you tell us what develop stage you are in? Have you completed the lab stage? Are you at a pilot plant stage?

Paul Sauvé: Certainly. The lab stage ended at least three years ago, and an initial pilot plant has already run once. Now we’re building a much more advanced commercial pilot plant that is currently under construction, engineering is almost complete and we will start building very soon. That will be in British Columbia.

Dr. Allen Alper: That sounds very good. Maybe I’ll go back to Sam for a moment. Sam, could you tell our readers/investors a little bit about your plans for the remainder of 2020, going into 2021?

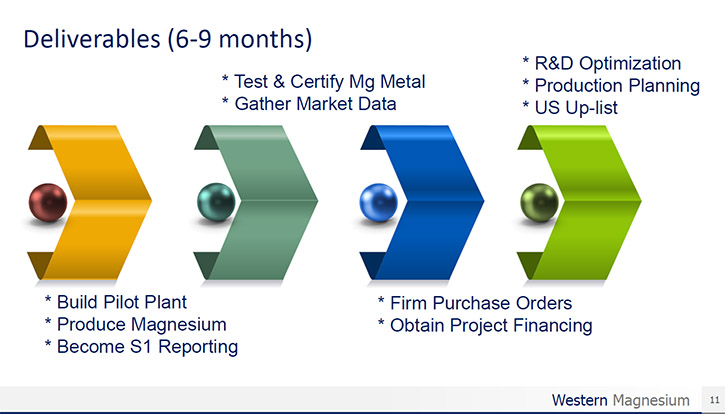

Sam Ataya: Absolutely. For now, we are in phase two of operations. We’re focusing on three areas in phase two. Number one, Paul referred to the commercialized pilot plant being built. That is very important for us for the data and analytics that it will give us to move on to build the bigger commercialized plants, which will all be in the United States. So that commercialized pilot plant will be completed by the end of 2020, and we plan on producing metal by first quarter of 2021. That is a big part of phase two and that’s what we’re working on right now. The other thing is that we are going to become S-1 reporting because on our corporate side, we re-domiciled the Company from Canada, and we are now a US domiciled corporation out of Delaware.

We still primarily trade on the TSXV for the moment and the OTCQB, but this S-1 reporting, we will be doing this conversion so we can lay down the foundations to move on to NASDAQ or New York stock exchange. So, that’s very much part of phase two, and again, completing in first or second quarter of 2021. And finally, the third thing we’re focusing on is laying down the foundation for where our plants are going to go in the United States. You have to start this process early, so right now we’re negotiating with different states, their governors and their economic committees on which sites are suitable for us and what contracts are we going to enter into. We plan on building more than one plant. And we’d like to conclude those again by first quarter or second quarter of 2021. So we’ve already laid down the foundations for the bigger commercialized plants that will be built across the United States. Those are our three focuses at the moment.

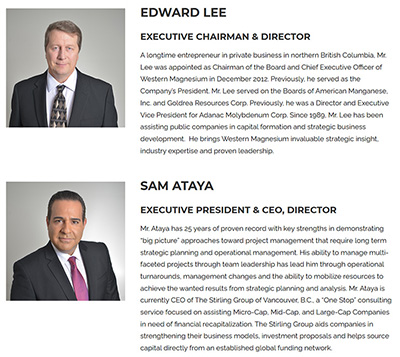

Dr. Allen Alper: Well, that sounds excellent. Sam, could you tell our readers/investors about your background and the teams’ to give them a better idea of your Company?

Sam Ataya: Absolutely. The team is made up of two parts, first is the technical scientific. Part of the challenge in building this team is that the industry in North America has been dormant for many, many years. In fact, when people ask me are there comparables in the magnesium industry, the answer is there are very, very few. The only operating magnesium plant in the US, that’s left, is operating out of Salt Lake City. So the comparables aren’t really there. But more importantly, what’s not there is the expertise in magnesium production. The technology that’s being used is old technology. It’s very difficult to find people that specialize or have history with magnesium. We are going to great lengths to find out who those people are, so we can add them to our roster.

We bring in a real depth of expertise when it comes to magnesium, specifically magnesium production. On the technology side, we go to great lengths to find out who’s out there so we can add them to our roster. On our corporate side, the depth comes in the fact that we really are focused on two things here. One is bringing to light this industry that has been dormant for many years, especially in North America. And two, we’re having to do a lot of education. It’s one thing to go out there and talk to institutional financiers, brokers, high-net-worth individuals and investors for the market. It’s another thing to go out there and explain what magnesium metal is. And initially there was not a lot of awareness.

So our corporate team had to focus on taking a step back and educating everybody around us. Because if you were to go out on the street and ask people, “What do you think of magnesium?” They’ll tell you, “Well, it’s good for my arthritis, I take it as a supplement,” or some people might even refer to mag wheels and they’ll say, “Well that’s how I know magnesium,” but to truly understand how much of a game changer this metal is, in a time of EPA requirements and lightweight materials needs, is so important.

We’re having to do a lot of education. So our corporate team had to be made up of people that have had experience in building what we call a cornerstone business, a disruptive technology, because that’s what we feel our Company is. When I’m asked the question, are we a commodity company, are we a mining company, are we a technology company, well, the short answer is yes to all three, but what are we really? We’re a technology company. We’re an industrial technology company that happens to delve into mining, if we have to, and obviously a commodity because we’re selling the metal. But when you are in that position, your expertise and management background has to be comprised of people that have been there, done that in multiple different industries, specifically in technology, and industrial technology, and also market awareness. And that’s what we’ve gathered as a team. For example, my background, I’ve been part of a turnaround, or I should say a core business of disruptive technology before, where it was a game changer, disruptive and a cornerstone business.

So this was very suited to my talent in the sense that I understood what it would take to bring something like this to market. We were not dealing with a business. For example, if I were making hamburgers and if I were going to compete with McDonald’s, Burger King, Wendy’s, and Shake Shack, then I would have to have a new product, a service or a technology to compete. Here, it’s really that there have been no new technology developments in many, many years. There have been no new plants built in the United States or in North America in 50 years. So we’re really having to bring talent in that can address all those factors that are challenging, and that have been challenging, but I’m happy to say that between the technology side of who we’ve been able to bring in and the expertise there and on the corporate side, we’re able to move this forward. I just want to give you the basis of how we go about bringing people on board, for a project like this.

Dr. Allen Alper: That sounds good. I think that gives our readers/investors an overview of how you’re setup to go forward. Could you tell our readers/investors about your share structure and capital structure?

Sam Ataya: Sure, absolutely. Right now we have about 322 million shares outstanding. We have a lot of investors, both in Canada and the United States. Our market was robust in trade per day. Obviously, COVID has changed a lot of things for a lot of people, and for us obviously, it has affected us. But, it’s interesting that COVID has not slowed down our operations or the speed at which we’re moving, our offices remained all open throughout the COVID crisis, although we’ve taken great care to make sure that everybody’s healthy and safe in our office. We just have so much to do that our office was kept open during this time period. However, when it comes to market share, we have 322 million shares outstanding. There are very few warrants outstanding on the Company right now.

The price is fluctuating between 11 and 13 cents at the moment, but it has gone high, as high as 35 cents. And again, it’s dampened by conditions of COVID and trading per day. But before COVID, we were averaging between 250 and 500,000 shares being traded per day. We’d go as high as 1.2 million shares being traded per day. So both on the US and Canadian side, we have a lot of long-term shareholders and also a robust market in the space that we’re in.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Western Magnesium?

Sam Ataya: I think there are two very, very important reasons that this is the right time. The first one is that our Company’s undervalued at this time. Part of the problem comes down to education. If more people become aware of the benefits of magnesium metal and what it can do, then the call to action is going to be there and we’re going to have a lot of investors come on board, and a lot of shareholders wanting to come into it, and that is going to drive the stock up. I think that’s starting to change significantly because government, especially in the United States, understands. In the US an executive order has been issued that put magnesium metal, for national security interests, on the 32 most protected metals list, and also put a 114% tariff on any magnesium metal coming into the United States from anywhere around the world.

So the United States is really going after the build-out and production of metals again in the United States. And that’s driving a considerable amount of value for what we’re trying to do. So I feel that for shareholders coming on board right now, the heavy lifting has been done. We’re six months away from producing metal and we’re about to get started. So this is the right time, the Company’s still undervalued and there’s a great upside to it. That’s a big one for me. We have not yet made the move to a major board, which makes it also the right time. So there’s a lot of benefit buying into the Company today, because there’s nothing but upside, especially when it comes to the valuation of the technology after the commercialized pilot plant is built. That will bring considerable value to our stock as well.

The second one is a personal one, although it’s corporate, it’s also personal to me, it’s personal to all of our staff. We want to be a green plant. We are going to be zero waste and close to, if not zero toxicity. That’s something that I’m very proud of and our team’s very proud of as well. We are not just simply going to be the greenest magnesium metal producer in the world, we are going to be simply the greenest metal producer in the world and be very, very proud of it! Because I know that whatever political party you favor, everybody wants to bring jobs back to America. We feel strongly that this kind of technology is bringing jobs that are long lasting for the next 100 years, with the new developments in technology and the new developments that we’re making when it comes to this industry. We’re very proud of that! So those are reasons I believe people should invest in this Company today.

Dr. Allen Alper: Well, that sounds like very compelling reasons to consider investing in Western Magnesium. Is there anything else you’d like to add, Sam?

Sam Ataya: We really believe in our Company that we want to be part of the tip of the spear to bring attention to the fact that in our countries, in North America, we need to bring back production, manufacturing and control of our own resources. We’ve given that up, we’ve given it away and now we’re scrambling to control it. The COVID pandemic has brought light to something that we’ve been talking about for many years now, which is that we have to be in control of our own resources. Just as we need to be able to produce our own food and our own medicine. We need to regain the ability to produce and manufacture competitively, using the latest technology.

Globalization only works when all countries are honest and fair, but it’s difficult to do when one country is beholding to another; one is manufacturing, producing and sending products to another country that cannot compete in that space. That is no longer globalization. That is simply beholding to another country. Fair play means that we have to be in control of production, manufacturing, and resources, within our own borders, and then go out in the world and compete and be the best we can be, and develop our industries. That’s what we used to do. That’s what made us number one in the past, and we’ve moved away from that. We moved away from that and it’s cost us dearly. It took something like a pandemic to bring that to light with governments, to bring that to light with industry, to bring that to light within the general public.

We need to be in control of resources, manufacturing and production. We’re not looking at going global, we’re interested in making this happen for the industries in the United States and within North America. That’s our interest. Right now there’re one million metric tons being produced globally, yet the demand in the United States alone, within the different industries, like the auto, aerospace, airline, eco-friendly technologies, government, and the military, is between 20 and 30 million metric tons or 20 to 30 times the world’s supply. That’s a very dangerous place to be in, but it’s a great upside for our Company, and yet another reason why you should be investing in our Company.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

David Melles

[email protected]

604-423-2709

About Western Magnesium

Western Magnesium’s goal is to be a low-cost producer of green, primary magnesium metal, a strategic commodity prized for its strength and lightweight qualities. Unlike outdated and costly production processes, Western Magnesium looks to use a continuous silicothermic process to produce magnesium, which significantly reduces manufacturing and energy costs relative to current methods and processes, while being environmentally friendly.

| Company Contact David Melles [email protected] (604) 423-2709 |

Media Contact Katie Kennedy [email protected] (610) 228-2128 |

Statements in this news release that are not historical facts are forward-looking statements that are subject to risks and uncertainties. Actual results may differ materially from those currently anticipated due to a number of factors, including the Company’s dolomite reserves may not be mined because of technical, regulatory, financing or other obstacles, the market price for magnesium may make our resources uneconomic and we may not be able hire and retain skilled employees. The Company undertakes no obligation to update forward‐looking information except as required by law. The reader is cautioned not to place undue reliance on forward‐looking statements. These forward-looking statements are made as of the date of this news release.Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or “U.S. Persons”, as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements. We Seek Safe Harbor.

View our profile on SEDAR