Junior Resource Investing: Arizona Gold & Silver: Permitted, Cashed Up, and Ready to Drill for the Source

Junior Resource Investing: Arizona Gold & Silver: Permitted, Cashed Up, and Ready to Drill for the Source

https://juniorresourceinvesting.substack.com/p/arizona-gold-and-silver-permitted

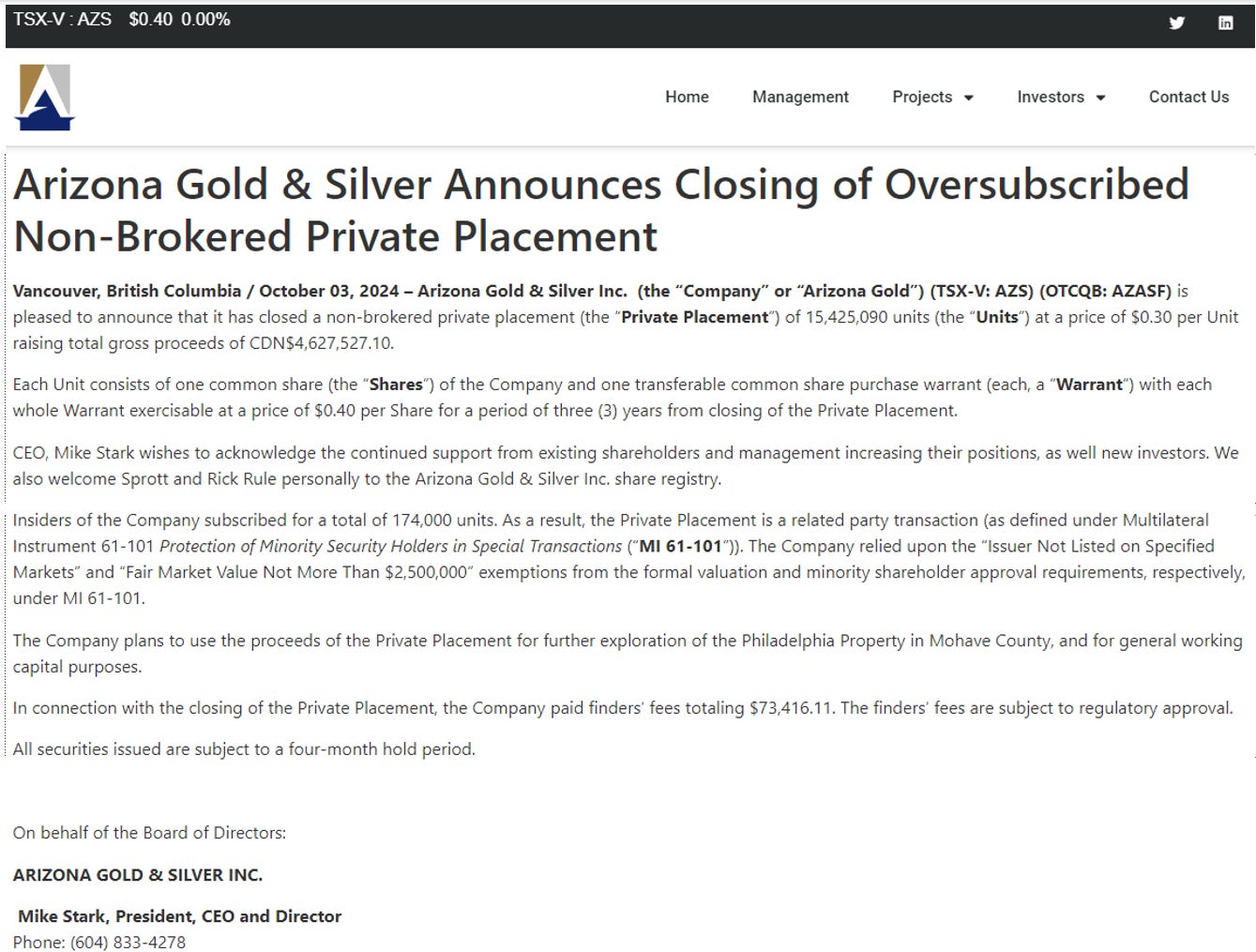

Financing for $3 million, they ended up with $4.6m and added Sprott and Rick Rule to the share registry. Fully permitted and cashed up, CEO Mike Stark joins me to discuss why Arizona has the big mo’.

tl;dr:

Building off my previous conversation with CEO Mike Stark, this news update from Arizona Gold discusses how they opened a $3 million financing on Sept. 18 and closed it for $4.6 million on Oct. 3, with Sprott and Rick Rule along for the ride. That impressive show of market interest now gives Arizona an enviable amount of runway to explore its Red Hills target, the long-suspected source of all their mineralisation to date discovered at their Philadelphia project – for the first time ever. Interview, Article, and Summary below.

Part 1: The Interview

Part 2: The Companion Article

For a more full explanation of Arizona’s imminent drill campaign and exploration potential, please check out a recent interview of mine with Mike Stark.

This one will be a quick-hitter. For one thing, I just sat down with Mike Stark for a long-form interview a couple months back, and, on a more personal note, baby is due to arrive at my house, well, yesterday, and external signs suggest it is approaching imminent. So there’s less need for my opining – and less time to do so anyway – than a typical update.

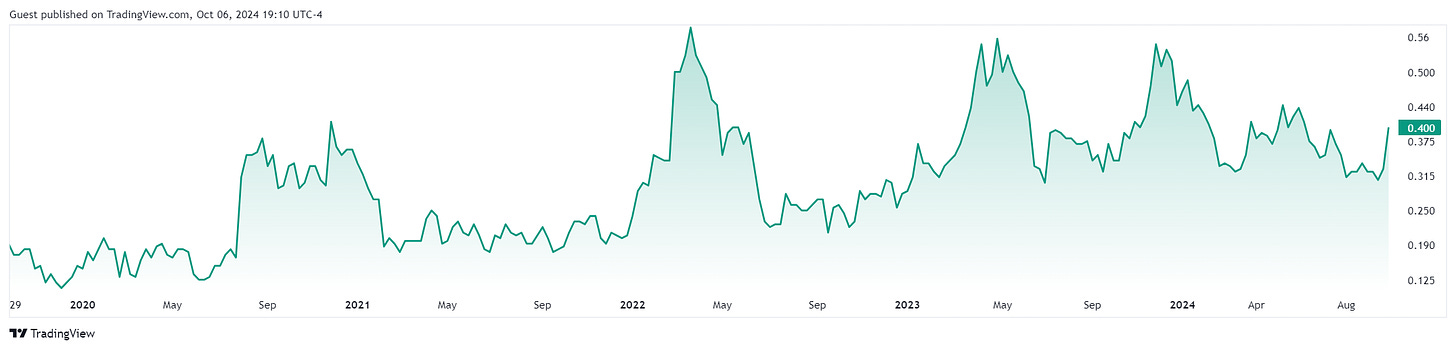

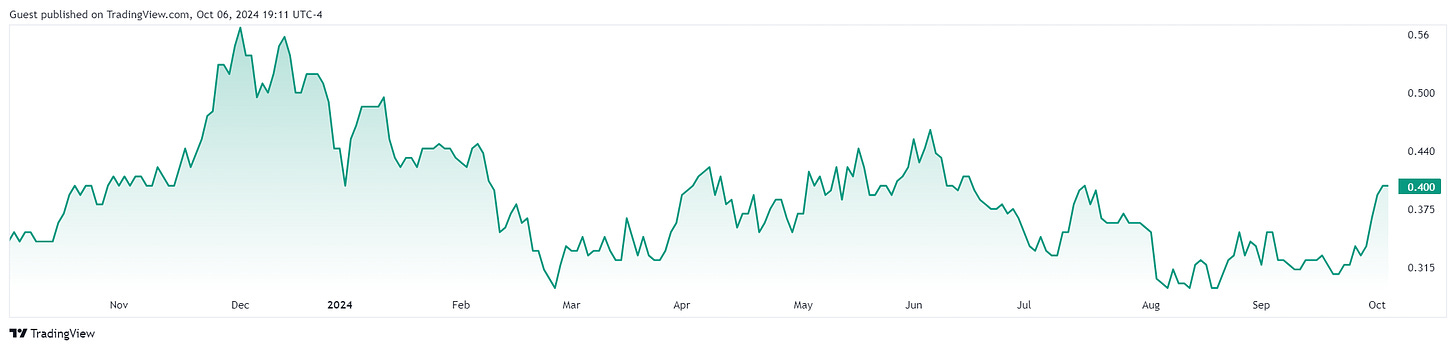

Still, this isn’t to say Arizona Gold & Silver doesn’t have much in the way of big news to report on. Far from it. Rather, they are – like I referenced in my update a month or two ago – poised for what could be a very nice little run indeed here. Like all things in life, timing can be everything, and the timing certainly appears to be right for Mike Stark and the team at Arizona Gold & Silver.

- BLM permits to drill the red hill finally in hand.

- A hugely successful (fast, very oversubscribed, with tier 1 investing names involved – doesn’t get much better than that) financing.

- A drill update coming as soon as this Tuesday (as per my chat with Mike) on exploring the suspected source of their mineralisation thus far.

- And, again as per my chat, a goal of having drill results by Christmas. (That is just two and a half months from now, just in case that’s sneaking up on anyone like it did me till just now.)

Opportunity cost is real, but it isn’t an issue here. This market is such currently that you can find good companies, good projects, good management, riding 52 week – or worse – lows. I’ve made this point before that you don’t need to risk outsmarting yourself looking for deep value picks in this sector right now – obviously-excellent choices have a whole lot of opportunity built into them at present valuations all over the sector. I believe this is one of those. Hence my participation in this last financing.

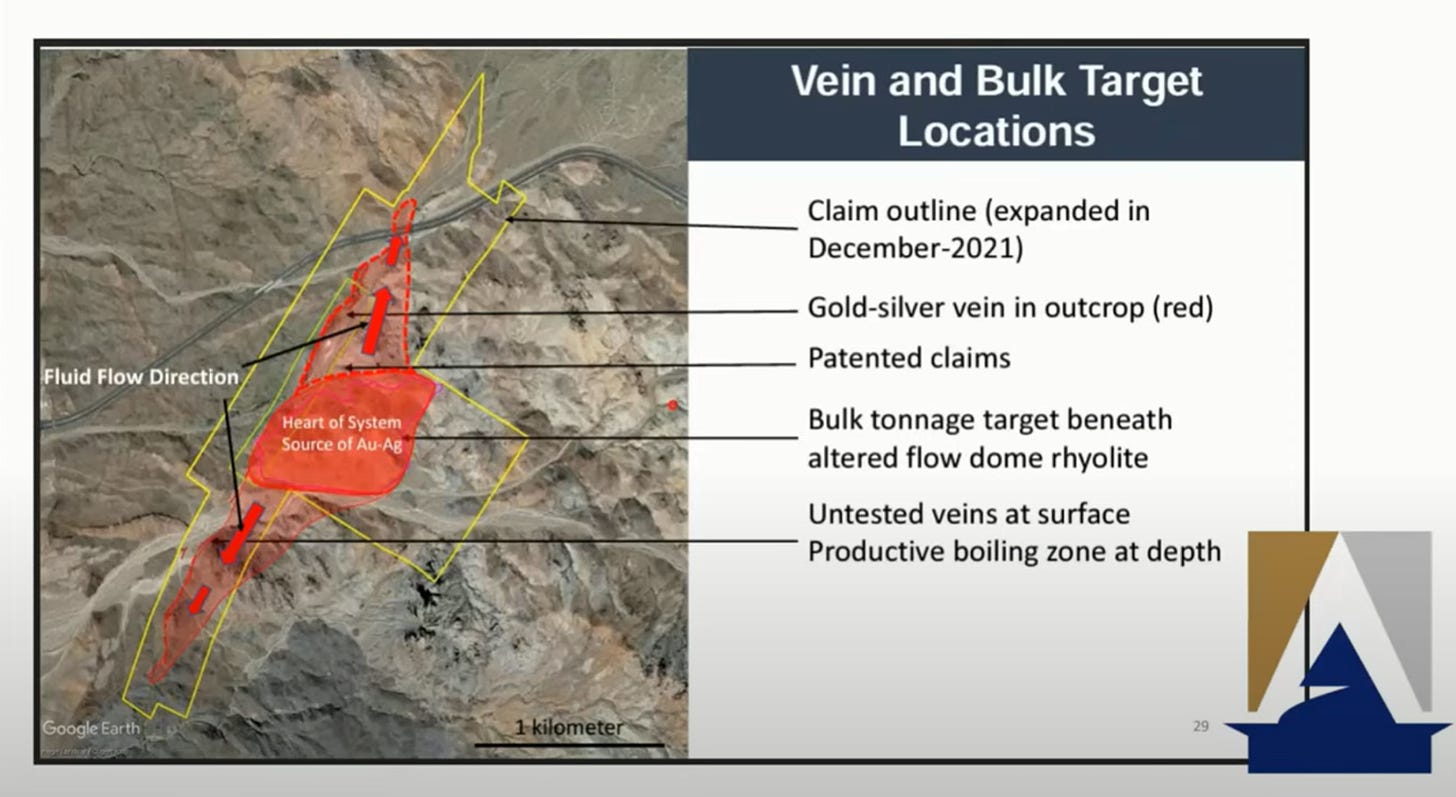

In the end, this is one of those classic value rerating opportunities this sector is defined by: If Arizona can prove up that the Red Hills are their source for all their vein and disseminated mineralisation drilled thus far that seems to be fairly obviously emanating from it, that has the potential to fundamentally alter the trajectory of this company for the better as it suddenly opens up the pathway to a significantly larger napkin-math resource estimate for this project. The fact that there are modern, recently-operating mills desperately hungry for feed just a few kilometers of Philadelphia, thus allowing Arizona to potentially bypass years upon years of planning and permitting to get to production? Well, that’s a pretty big deal all on its own that only further cements the potential opportunity here.

Indeed, it seems to me that the question isn’t so much “is it the source” as it is “it is the source, but how much of the good stuff got capped and contained”. With a big cap of clay resting atop the Red Hills, hope springs eternal in that regard as well. Like I say, I’ve placed my bets, so I guess that makes me a believer.

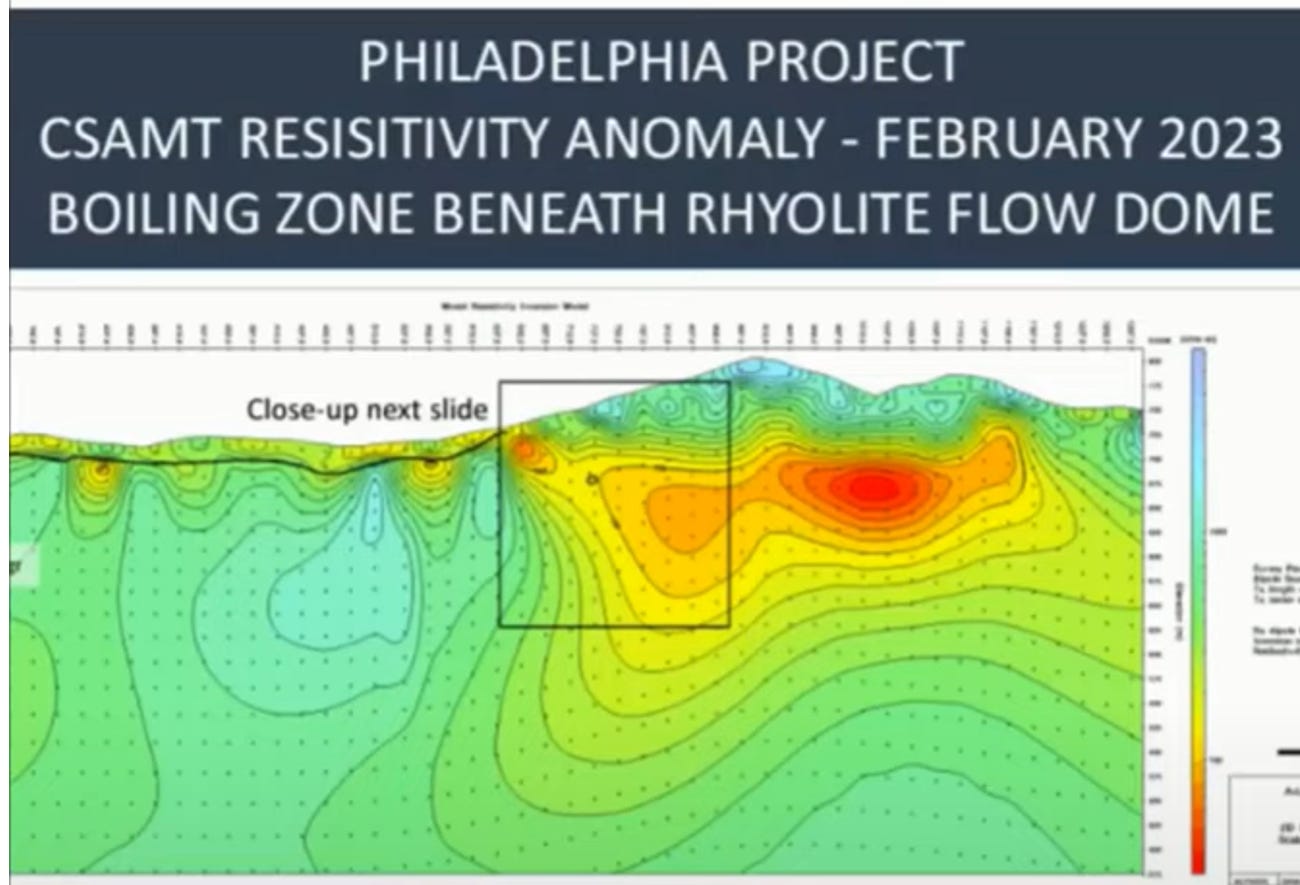

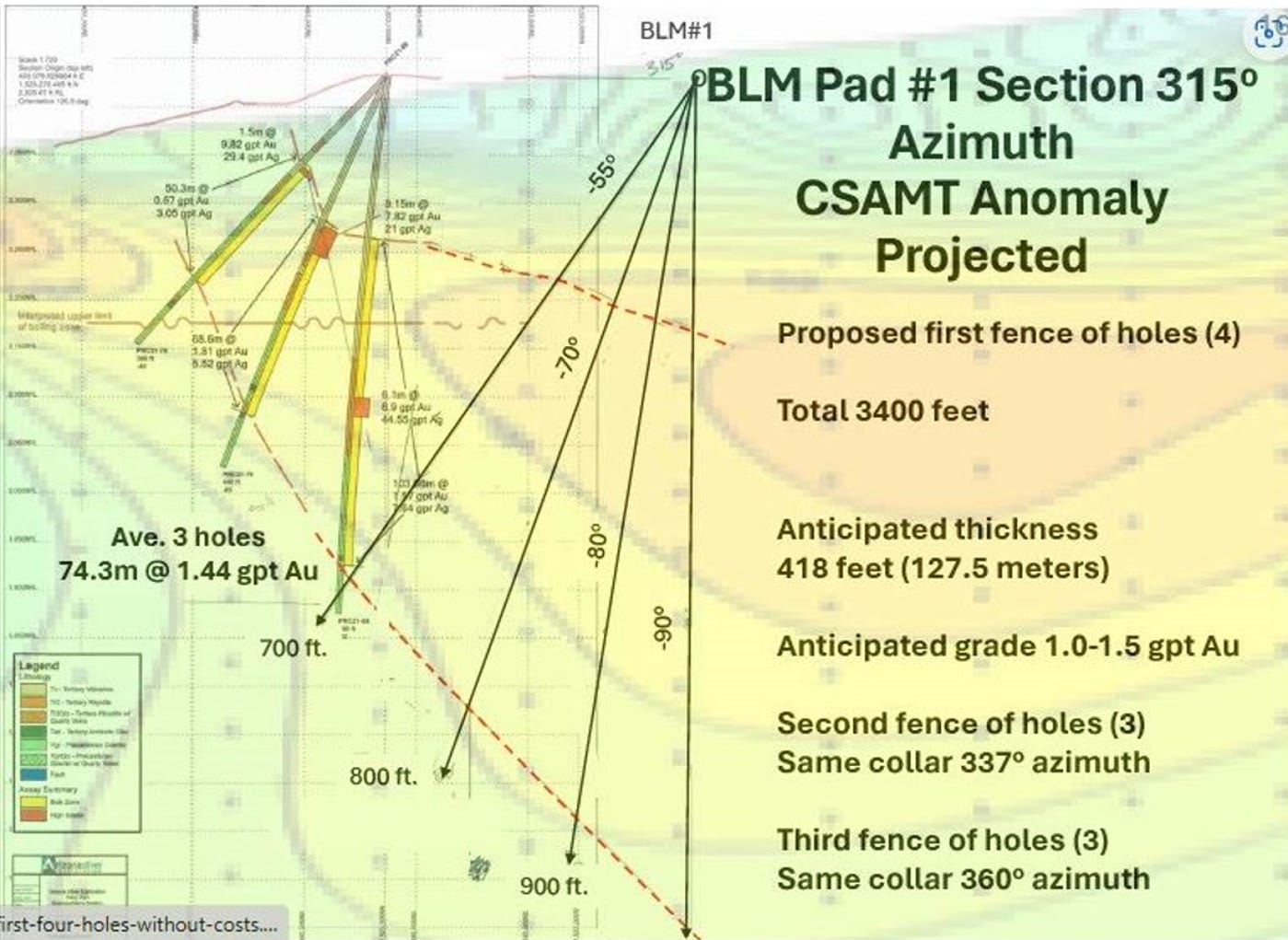

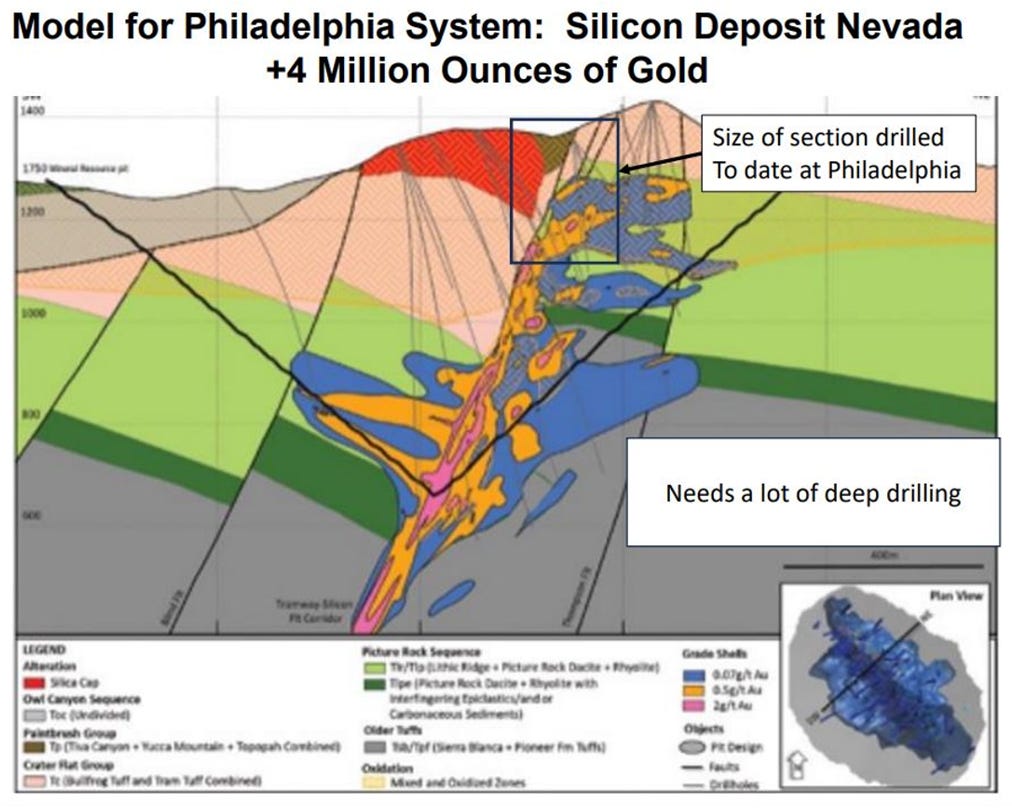

The next two images demonstrate why this boiling zone source looks like it has indeed been contained. For one thing, geo phys data overlays nicely with nice little hits of grade found at depth in previous drill holes. Then, overlaying the BLM-permitted pads and planned fan of holes shows how Arizona will be able to finally start to target this perceived source. It seems clear that Arizona is set up nicely to settle the question substantially with this next drill campaign, and while there’s no sure things in love or geology, but there’s certainly weighted odds.

So yeah, I like this one. I like Mike. He passionately believes in this company and its team and works his butt off. I like the location and jursidction. I like the opportunity and size of the potential prize, and the timing is darn near perfect. With results potentially by the end of the year, this is one that could be in for a nice little run over the next couple quarters.

All that’s left is to drill.

Part 3: The Written Summary

00:30 Intro to News Release

- Mike has been in contact with Sprott for a few years now.

- Have been to site.

- $850,000 lead order from Sprott

- Rick Rule also invested.

02:20 How did Rick Rule come about

- Sprott connected him.

- Rule doesn’t just come into every deal

3:50 Cost of Drilling

- No longer doing RC drilling.

- With diamond core, expecting US $150/foot, all in (lab etc).

- Have always ended up a little under budget in all their campaigns.

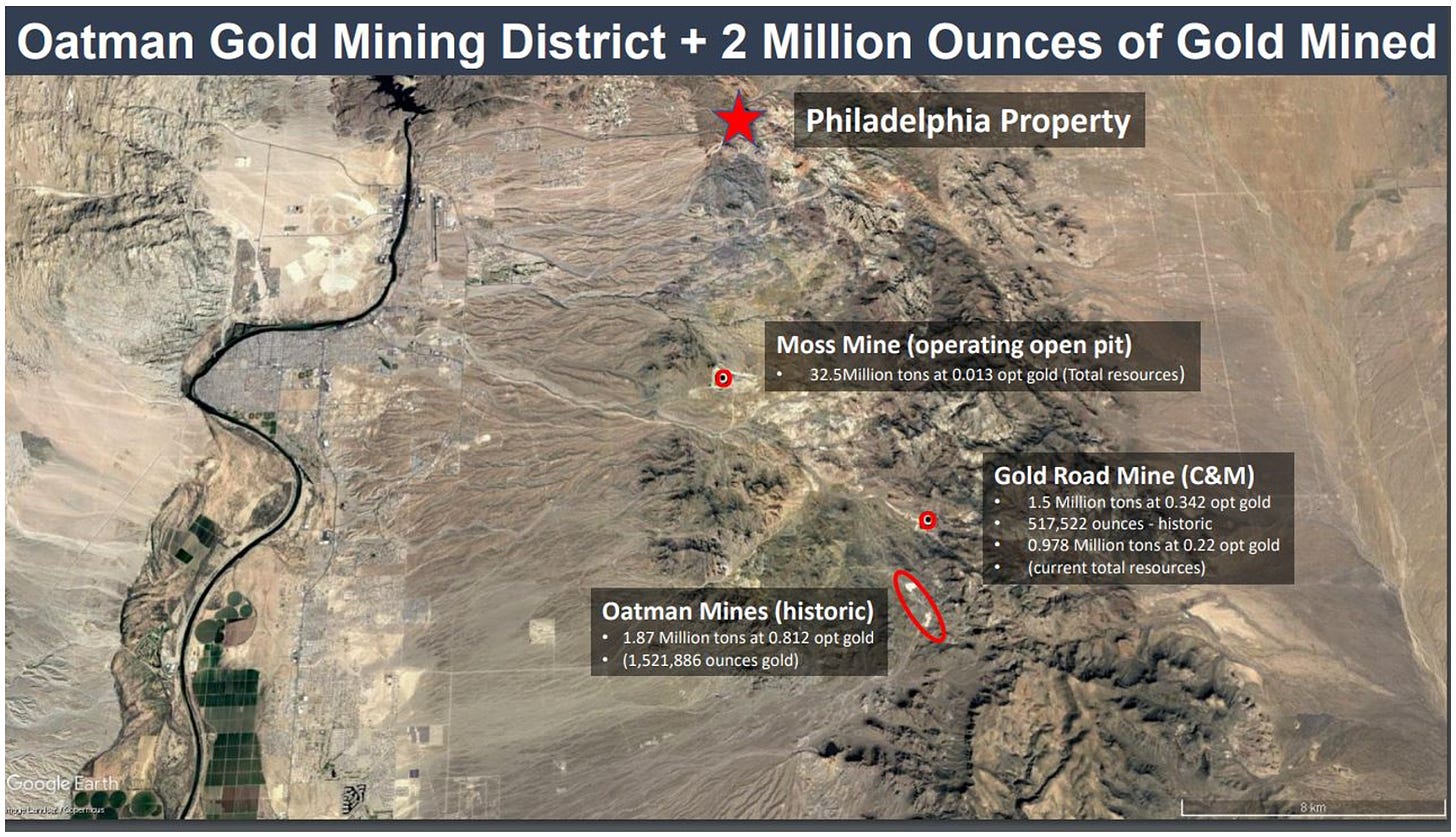

5:20 Review: Oatman District – what is in it

- Believes it will gain the attention of majors soon.

- There are two mills just a few km away on care and maintenance.

- Both need more feed than their current mines have available.

- The district is ripe for the picking – known mineralisation, further exploration potential, and high quality mills.

- They have designed and priced out a conveyor belt system to get ore to the moss mine (which is 8000 tpd)

- Moss Mine mill is only 5.5 years old

- Saves on 5 or 10 years of permitting process to get to production.

- Multiple news confidentiality agreements have been signed.

9:00 What are the Red Hills you plan to drill and why is this a significant program for you

- Finally getting a chance to drill what they believe is the heat source for the mineralization of the system they have drilled so far to the north and south for some 1.6km of strike.

- Even if they miss – and they believe chances of success are high – there is still 1.5km to the south of exposed vein outcropping and future drill targets.

- But the red hill is what they are excited by.

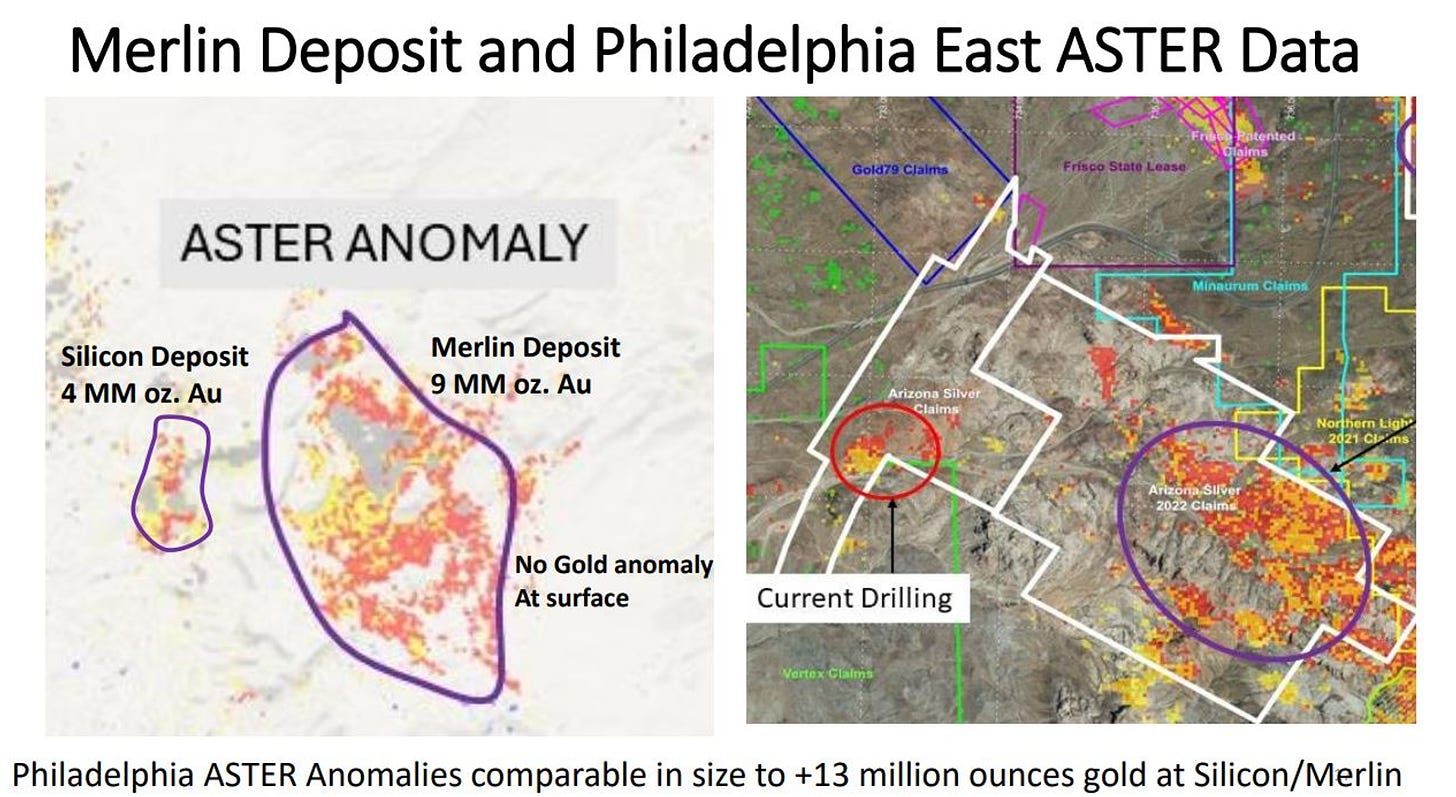

- Red Hill, and their Philadelphia project in general, has the scale to produce scale, so to speak – the size of alteration that could be a massive system.

- They plan to head east to a much larger anomaly soon enough as well.

- They have plans to go at least 300m deep but will go as deep as the mineralisation takes them.

12:30 BLM-approved drill pads and drill plan

- Previous holes averaged 74 meters of 1.44 grams

- CSAMT data suggests they are just missing tagging the heart of it

- The shape suggests the chance for very large intercepts.

15:00 When will we see drilling?

- Agreement signed with a driller.

- Look for news early next week on this front, but expect optimistic/positive news.

- Very proud of his team and how they have all worked together so well.

- Relief it is all coming together finally.

17:10 Hoped for drill campaign size?

- Very fluid.

- 4 holes to be drilled at a time – depth of them based on depth of mineralisation

- After first 4 they will switch over to pad #2.

- 40 hole program permitted.

- Could drill up to 1600 or more feet deep

- 4,000-5,000 metes estimated size currently

19:00 Final Thoughts

- $4.6 million allows them to do significantly more than $3 million.

- Hope to get at least one hole out of the lab before Christmas.