Dear Reader,

The team at Sprott has been hard at work, ducking, diving and weaving through the maelstrom of market data – be it energy, uranium, copper, gold, silver, platinum, “rare earths”, or even more obscure and long-forgotten commodities.

Of course, the big piece of news last week was the Israeli attack on Iran, sending 200 fighter jets to hit over 100 strategic assets, including nuclear enrichment facilities, scientists, and commanders. “As many days as it takes,” said Netanyahu. Trump weighed in, “Excellent”.

No Peace in the Middle East… Yet another sad war front, countless more deaths and misery.

Crude oil rose sharply. Fertilizer markets did too as Iran is the third largest global exporter of urea, a nitrogen fertilizer.

Yet again, gold is distinguishing itself as a safe haven. Bitcoin was down, and so were US bonds. Both trading more like risk assets than defensive positions.

The likely implication, of course, is higher inflation, higher bond yields, and lower economic growth (i.e. stagflation).

Paul Wong, Sprott’s Market Strategist, was on the case last week, publishing a lengthy note on gold, which you can read here.

I’ve gone through and picked out the most salient points, which you can read below. |

| “The U.S. has now paired century-high tariff rates with an increasingly unilateral foreign-policy stance, walking away from multilateral frameworks and casting doubt on long-standing security guarantees. The Trump administration argues that the U.S. dollar overvaluation and reserve-currency obligations undermine U.S. industry. It is openly questioning whether the U.S. should continue to underwrite the system it built and has maintained for generations. Foreign investors, however, see something different: a surging U.S. fiscal deficit near 7% of GDP, tax-cut proposals skewed toward the very wealthy, and an executive temperament that appears erratic and authoritarian.

“While investors question the neutrality of Treasury bonds and the stability of the U.S. dollar they reach for non-sovereign stores of value, primarily gold bullion. Commodities with robust supply-demand fundamentals also stand to benefit from a structurally weaker U.S. dollar and from investors’ search for real assets that hedge against both inflation and geopolitical disorder. The bond market, by contrast, faces a future in which yields may drift higher even during slowdowns, reflecting not just inflation risk but also a creeping discount for political unpredictability.

“Structural inflation constitutes another pressure point on government spending. It is driven by factors like deglobalization, tariff and trade tensions, an aging population, larger defense budgets, the green transition and a rising cost of capital. Combined, these forces place heavy fiscal demands on governments.

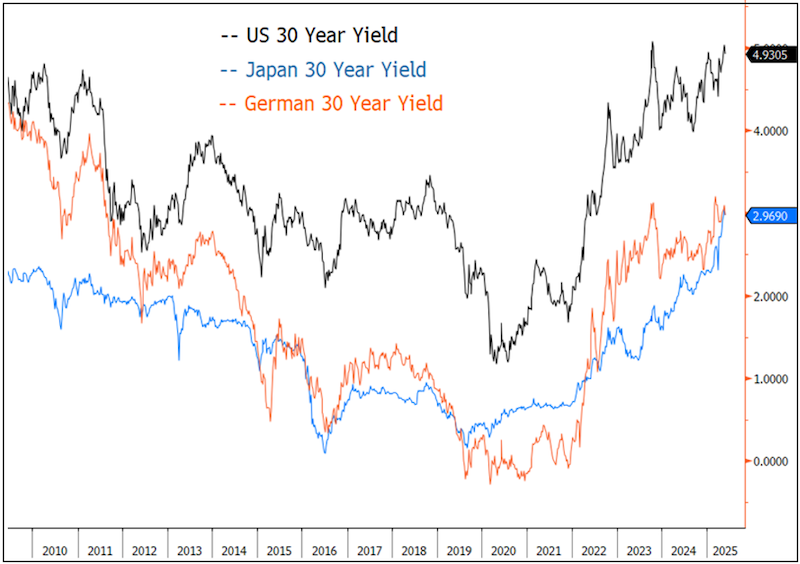

“The rise in long-term yields is not unique to the U.S. It is a global trend. Countries like Japan, the UK and Germany are seeing similar pressures, with yields climbing as fiscal risks mount. Japan, for example, is grappling with a debt-to-GDP ratio exceeding 200%, and the country’s central bank has struggled to cap rising yields. This underscores the fact that high levels of sovereign debt and rising yields are a global risk. |

|

“The failure to address growing deficits, has only worsened the outlook for long-term debt management. A case in point is the latest proposed U.S. spending bill which is projected to add about $2.4 trillion to the national debt over the next 10 years.

“As the ‘sell America’ trade intensifies and bond vigilantes return to the market, the pressure on governments to stabilize their debt and restore investor confidence will only increase. Whether through fiscal reforms, debt restructuring or financial repression, the coming years will likely be marked by significant challenges in managing sovereign debt with potentially severe consequences for economic growth and financial stability.” |

| Perhaps in preparation, central banks have been loading up on gold. Take a look at the chart below showing the sharp increase in central bank purchases of gold since the US weaponized the dollar. Gold is now the second largest component of global central bank reserves, weighing in at roughly 20%. For reference, central banks allocated as much as 70% of their reserves to gold back in the late 1970s. |

|

Golden Opportunities – Buy Commodities; Sell Bonds

Golden Opportunities – Buy Commodities; Sell Bonds Golden Opportunities – Buy Commodities; Sell Bonds

Golden Opportunities – Buy Commodities; Sell Bonds