Stay alert to the latest news on gold, plus our unique perspectives on the geopolitical and economic events that affect investments in natural resources and emerging markets. Stay alert to the latest news on gold, plus our unique perspectives on the geopolitical and economic events that affect investments in natural resources and emerging markets. |

Gold and Commodities Set to Soar in 2019

by Frank Holmes |

|

|

|

|

| Goldman Sachs is bullish on commodities and gold, recommending an overweight position for both. The investment bank also raised its 12-month price forecast for gold up to $1,425 an ounce, a level last seen in August 2013. |

|

|

|

|

|

|

|

In a bullish move, China added to its gold reserves for the first time since Oct. 2016.

|

|

|

Industrials were the best performing sector while consumer staples were the worst.

|

|

|

|

MARKET RECAP

|

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.40 percent. The S&P 500 Stock Index rose 2.54 percent, while the Nasdaq Composite climbed 3.45 percent. The Russell 2000 small capitalization index gained 4.83 percent this week.

- The Hang Seng Composite gained 4.02 percent this week; while Taiwan was also up 4.02 percent and the KOSPI rose 3.25 percent.

- The 10-year Treasury bond yield rose 2 basis points to 2.70 percent.

|

|

|

|

The U.S. is likely to lose its crown as the world’s most powerful economy next year.

|

|

|

Copper and aluminum are the top metals picks for 2019, says UBS.

|

|

|

|

|

Greece was the best performing country, while the lira was the worst performing currency.

|

|

|

The Indonesian rupiah and Philippine peso have continued to strengthen as of late.

|

|

|

|

|

Cryptocurrencies experienced a drop this week, with bitcoin falling past $4,000.

|

|

|

|

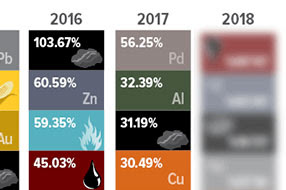

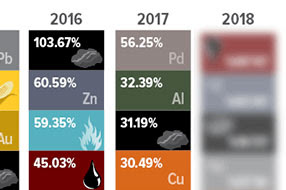

LEADERS AND LAGGARDS

|

|

Gold and Commodities Set to Soar in 2019

Gold and Commodities Set to Soar in 2019 Stay alert to the latest news on gold, plus our unique perspectives on the geopolitical and economic events that affect investments in natural resources and emerging markets.

Stay alert to the latest news on gold, plus our unique perspectives on the geopolitical and economic events that affect investments in natural resources and emerging markets.