Moores Testimony 2-5-19 SENR Cmte Hrg.pdf – The Case For Battery Metals

Moores Testimony 2-5-19 SENR Cmte Hrg.pdf – The Case For Battery Metals

Tartisan Nickel Corp. owning the Premier Asset in our space ripe for future exploration, development and mining.

Tuesday 5 February 2019

Written Testimony of Simon Moores, Managing Director, Benchmark Mineral

Intelligence

For: US Senate Committee on Energy and Natural Resources Committee

Hearing: Tuesday, February 5 2019, at 10:00a.m. Room 366, Dirksen Senate Office Building in Washington, DC.

Subject: Outlook for energy and minerals markets in the 116th Congress.

We are in the midst of a global battery arms race in which the US is presently a bystander.

Since my last testimony only 14 months ago, we have reached a new gear in this energy storage revolution which is now having a profound impact on supply chains and the raw materials that fuel it.

The advent of electric vehicles (EVs) and the emergence of battery energy storage has sparked a wave of lithium ion battery megafactories being built.

Benchmark Mineral Intelligence is now tracking 70 lithium ion battery megafactories under construction across four continents, 46 of which are based in China with only five currently planned for the US. When I gave my last testimony in October 2017, the global total was at 17.

Only one of these battery megafactories is American owned (Gigafactory 1, Tesla). This, however, was the world’s biggest battery plant and fourth biggest battery producer in 2018.

Since October 2017, planned lithium ion battery capacity in the pipeline for the period 20192028 has risen from 289GWh to 1,549GWh (1.54TWh) in Benchmark Mineral Intelligence’s February 2019 Assessment. This expanded capacity is the equivalent of 23-24 million sedan-sized electric vehicles.

This increasing scale will be a contributing factor to pushing lithium ion battery production costs below $100/kWh in 2019, Benchmark Mineral Intelligence data shows. This figure is long seen as a tipping point for the adoption of mass market EVs.

Almost exclusively, these megafactories are being built to make lithium ion battery cells using two chemistries: nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminium (NCA).

This means the supply of lithium, cobalt, nickel and manganese to produce the cathode for these cells, alongside graphite to produce battery anodes, needs to rapidly evolve for the 21st century. However, the scaling up of these chemically engineered materials, which are not commodities, is a major challenge for the industry.

Those who control these critical raw materials and those who possess the manufacturing and processing know how, will hold the balance of industrial power in the 21st century auto and energy storage industries.

At the beginning of 2019, the US has a minor to non-existent role in most of the key lithium-ion battery raw materials and only has a presence in lithium ion battery manufacturing via Tesla. Tesla and its Gigafactory 1 is emerging to be the most strategic US asset in the EV supply chain.

Chart 1: Build out of lithium ion battery capacity from 2018 to 2028

Source: Benchmark Mineral Intelligence

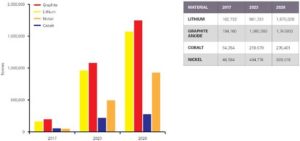

Chart 2 Lithium ion Battery Megafactory Raw Material Demand (tonnes)at 100% Utilisation Rate

Source: Benchmark Mineral Intelligence

The growth trajectory expected for lithium ion battery raw material demand is unprecedented.

Lithium ion batteries are becoming a major global industry and the impact on the four key raw materials of lithium, cobalt, nickel and graphite will be profound.

Chart 2 shows the theoretical demand from megafactories in the pipeline at 2023 and 2028. It assumes a 100% utilisation rate where each and every plant is constructed and operated at full planned capacity.

Under this scenario, lithium demand will increase by over eight times, graphite anode by over seven times, nickel by a massive 19 times, and cobalt demand will rise four-fold, which takes into account the industry trend of reducing cobalt usage in a battery.

The real-world expectation is that 70% of this capacity will be realised by 2028 yet even at full capacity this will not yield enough lithium ion batteries for EVs, energy storage and mobile technology.

As a result, this global battery megafactory trend will continue.

This would still cause major disruption in the mineral industries supply of lithium ion batteries and the US is heavily import reliant on all four.

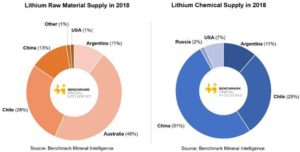

Lithium:

US Lithium Import Dependency in 2018: 92%.

US mineral supply chain influence is greatest in lithium compared with its battery raw material counterparts, but China remains the most influential player in this supply chain.

In the US, there is currently one small lithium operation in Silver Peak, Nevada, but its output is not destined for the EV battery market.

The key US strengths are through lithium producers, Albemarle Corp and Livent Corp.

Albemarle has begun to increase its supply base from an over-reliance on lithium from Chile’s Atacama. The EV demand outlook together with a number of political issues in the country has resulted in the company investing $1.15bn on a 50:50 joint venture with Mineral Resources Ltd to build a new lithium feedstock (spodumene) mine and downstream chemical processing facility in Australia.

It is a strategic move by one of the first companies to build spodumene processing capacity that is geared for the lithium ion battery industry outside of China.

This building of the lithium to EV value chain should be happening in the US.

FMC Corp has recently spun out its lithium business into a new company, Livent, to renew its focus on the EV battery market. One would expect this to result in the company increasing its resource base from the Salar de Hombre Muerto in Argentina and to expand its downstream processing capacity.

Despite this activity from US majors, there is yet to be any major domestic plans to build either new mines or major new chemical processing capacity for the EV battery market.

It is also important to note that US lithium producers have been secondary movers when compared to China’s lithium majors: Ganfeng Lithium and Tianqi Lithium.

For the past 5 years, both companies have locked up the world’s best lithium assets, struck long term supply agreements for EV batteries, and funded a significant portion of lithium’s exploration and development cycle, especially in Australia.

A major driver for this is China’s lack of high quality domestic lithium resources. US companies have had the opportunity to lock up international lithium resources for the last decade but hesitated while Chinese producers invested.

Domestically, the US still has an opportunity to develop its own supply of lithium from a wide variety of sources including South Arkansas’ Smackover (oil field brine), North Carolina’s Piedmont (spodumene), Nevada’s Silver Peak (continental brine), and California’s Salton Sea (geothermal brine).

Funding for these new sources has been limited to date as institutional investors seek safe havens for their lithium dollars – Chinese, Australian or South American based companies and assets – rather than the longer-term opportunity which a US domestic supply of lithium brings.

Outside of these typical finance providers, industry stakeholders are another potential funding source: lithium producers, battery makers, and car manufacturers are the most likely candidates. But to date, these major corporations have been risk averse and more concerned about share price and shareholder value than longer-term investments set to benefit the health of the US supply chain.

The rate of funding to build new lithium mines and downstream processing needs to double.

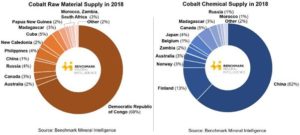

Cobalt:

US Cobalt Import Dependency in 2018: 100%.

Cobalt is a critical safety component of the lithium ion battery, and while auto makers are seeking to reduce their consumption of this mineral, it is our opinion that cobalt will not be engineered out of a lithium ion battery in the foreseeable future.

The US has little control over the cobalt supply chain, either with mining, in which the Democratic Republic of Congo (DRC) is increasing its dominance, or refining, where China holds the balance of power.

The most strategic US asset in the cobalt industry is Freeport Cobalt (owned by Arizona’s Freeport McMoRan Inc) which owns the only major cobalt refiner outside of China, but still acquires 100% of its raw material from the DRC – a Chinese run mine that it used to own.

Another factor we do not see changing is the reliance on the DRC as the world’s primary source of cobalt – in fact we are seeing DRC supply-side dominance increasing from 64% of global supply in 2017 to 69% in 2018.

While controversy surrounds cobalt from the DRC, and its link to child labour has been well publicised, what is key to understand is that less than 5% of total supply is affected by this. It is, however, a major social responsibility issue for electric vehicle and battery makers to manage.

The world’s auto makers are now well versed in the risks the DRC brings, yet at present there is no other option for a large-scale supply of cobalt to come from other countries – new resources will need to be developed.

The US has an opportunity to develop its own domestic supply of cobalt.

Regions such as the Idaho-cobalt belt, which is globally known as being a cobalt rich jurisdiction, presents one of the few opportunities for US cobalt supply security.

Cobalt remains the highest risk lithium ion battery raw material, both from a supply structure perspective and a geopolitical one.

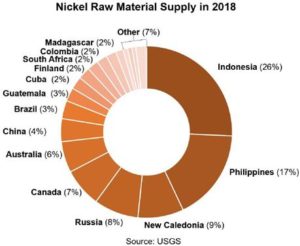

Nickel:

US Nickel Import Dependency in 2018: 59%

As lithium ion battery manufacturers reduce the amount of cobalt used in battery cells, nickel consumption rises and it does so in a major way.

The move to what the industry calls high-nickel cathodes or NCM811 (8 parts nickel, 1 part cobalt, 1 part manganese) is set to put significant pressure on the nickel to EV battery supply chain.

Over 90% of new lithium ion battery capacity in the pipeline is planning to use NCM cathode chemistries, and nearly all new capacity targeting the EV market will use NCM811 and the improved energy density benefits it brings.

This means the 2.2 million tonnes-a-year nickel industry has to re-gear to supply nickel sulphate or mixed nickel-cobalt hydroxide for these battery plants.

Nickel’s use in lithium ion batteries accounted for 85,000 tonnes in 2018 yet this was only 4% of total nickel demand. However, nickel demand from EV batteries is set to grow by between 30-40% a year, making it the fastest growing battery raw material.

On the surface, global nickel supply seems fairly evenly spread. Indonesia and the Philippines lead the way with a number of significant producers elsewhere, such as New Caledonia, Russia, Canada and Australia.

However, China is investing heavily in both Indonesia and the Philippines to guarantee its supply of nickel and related products used in the battery industry such as mixed nickel-cobalt hydroxide and nickel sulphide.

In 2019, consumers are turning to new mines under construction in Indonesia that use a high-pressure-acid-leach (HPAL) method to extract nickel. A number of HPAL projects in the

past have failed and therefore new nickel supply for the battery industry is far from guaranteed.

Graphite:

US Graphite Import Dependency in 2018: 100%.

While lithium, cobalt and, more recently, nickel have received much of the attention and the bulk of investment in new capacity globally, China has quietly led the way in the expanding graphite industry for the EV market.

This is perhaps unsurprising given that China dominates both the mining and refining side of the flake graphite to anode supply chain.

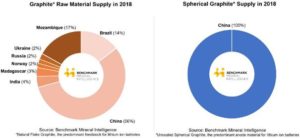

In 2018, China was responsible for 56% of the world’s flake graphite supply – the mined feedstock that is used to manufacturer lithium ion battery anodes.

China also accounted for 100% of the world’s uncoated spherical graphite supply, which is the processed anode material that is used in lithium ion batteries.

The country’s leading producers of anode material – BTR New Energy, Shanshan Technology, and LuiMao Graphite – are leading China’s spherical graphite expansions to a cumulative 420,000 to 450,000 tonnes per year by 2020. This four-fold increase is a direct response to China’s soaring domestic EV demand.

The US has zero graphite mining or processing capacity geared towards the lithium ion battery industry. While graphite can also be synthetically produced and used in batteries, domestic synthetic graphite expansions have not yet occurred on a significant basis.

The US does not have any active US flake graphite mines nor does it have any capacity to produce anode material from this feedstock. The most strategic US asset in the anode supply chain is German-owned synthetic-producer, SGL Carbon, which has a number of production sites and knowledge bases in Ohio, Pennsylvania, North Carolina and Washington state.

Considering China’s position across the entire graphite to EV value chain, secure supply of anode material is as big a risk as cobalt for US to consider.

Source: Benchmark Mineral Intelligence

About Benchmark Mineral Intelligence

Benchmark Mineral Intelligence is the world’s leading voice and most trusted provider of independent price assessments for the lithium ion battery and electric vehicle (EV) supply chain.

Benchmark is globally known for setting the lithium industry’s reference price which is relied upon to negotiate contracts between actors in the industry, including lithium extraction operators, to cathode manufacturers, battery cell producers and automotive OEMs.

Benchmark’s Lithium Price Assessments and analysis is also relied upon by the financial community to aid critical investments into the lithium ion supply chain.

The company also produces regular price assessments on cobalt chemicals and graphite anode and also assesses lithium ion battery megafactory capacity build out.

The EV and battery cell supply chain is Benchmark’s sole focus and speciality.

In addition to and wholly separate from its Price Assessment Division, Benchmark also provides lithium forecasting and consultancy services that are relied upon by a wide range of customers from governments, electronics manufacturers, EV makers, battery cell producers, and lithium miners.

To complement its publishing activities, Benchmark has created the industry’s leading platform to discuss the subject – The Benchmark World Tour. Starting in 2015, the annual series offers free investment and industry seminars, has grown to 15 cities in North America, Europe, Asia and Australia.

Benchmark also hosts an industry gathering for the lithium ion supply chain in November of each year. Benchmark Minerals Week consists of two main conference, Graphite & Anodes and Cathodes, and is the world’s meeting place to negotiate deals and network.

Benchmark’s price data, insight, and understanding of the subject is unrivalled and culminated in being summoned to the US Senate to testify in 2017 and 2019. In addition, Benchmark has been invited to give guest lectures at the University of Oxford and advise the UK Government.

About Simon Moores

Simon Moores is the world’s leading authority on lithium ion battery and energy storage supply chains with a specialist focus on lithium, graphite and cobalt.

Simon is managing director of Benchmark Mineral Intelligence, an independent price assessment and consultancy company for lithium ion battery supply chain and he has gained unique insight into this opaque world since 2006 when he began his career in lithium.

As a result, Simon and Benchmark are cited around the world in international press, official filings and in government research.

In October 2017, Simon was summoned to testify to the US Senate Committee for Energy & Natural Resources in Washington DC as an expert witness on energy storage supply chains. He has also been invited to give regular guest lectures to the University of Oxford and has spoken at Stanford University.

Benchmark Mineral Intelligence has also advised some of the biggest actors in the lithium ion battery space from battery manufacturers, to electric vehicle producers and mining companies, regularly travelling to meet these players across the world from Chile to China.

Benchmark has developed and launched the lithium industry’s reference price which is assessed each month by Benchmark Mineral Intelligence, published Bloomberg, Thomson Reuters, and used by the industry to negotiate contracts.

Simon and Benchmark are widely quoted in the global media including China Daily, Financial Times, New York Times, Wall Street Journal, Washington Post, The Times, Bloomberg, Thomson Reuters, The Economist, Chicago Tribune and Fortune.

Benchmark has also advised leading banks such as Goldman Sachs, UBS, CLSA, Deutsche Bank and Bank of America Merrill Lynch and the world’s most influential funds.

Benchmark also host three annual events: Cathodes Conference, Graphite + Anodes 2018 and the Benchmark World Tour. These events are the industry’s leading platforms for lithium ion supply chain information and deal-making in the supply chain.

Simon has a BSc in Geology with Geography from the University of Birmingham, UK.

https://www.tartisannickel.com/