Approaching a Boiling Point: Arizona Gold & Silver

Approaching a Boiling Point: Arizona Gold & Silver

https://open.substack.com/pub/juniorresourceinvesting/p/approaching-a-boiling-point-arizona

CEO Mike Stark catches me up on AZS.V’s ongoing drill campaign and other recent news with critical discovery drilling on the Red Hills imminent.

tl;dr:

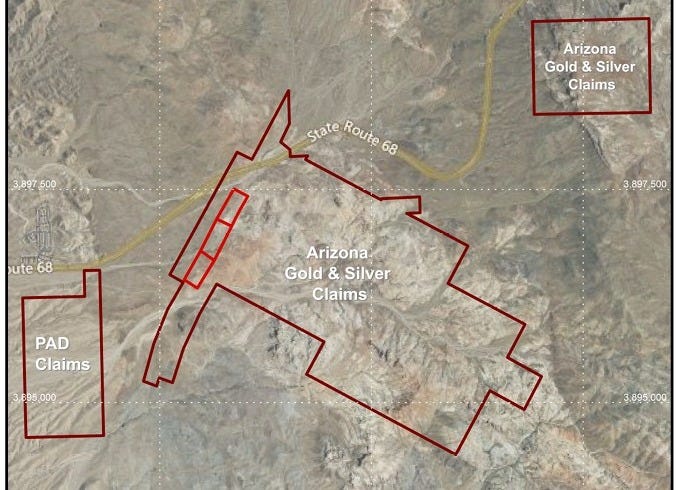

I sat down with CEO Mike Stark for a brief news update. Since we last spoke, the company has released a couple sets of results from their ongoing drill campaign at their Philadelphia project, acquired land for a future heap leach pad, and have announced some $3.2 million in the bank in part courtesy of significant insider option exercising.

AZS is still drilling as it builds towards its maiden resource within the next 12 months or so. And with the rig imminent at BLM Pad 2, they have a chance to fully and properly prove their “boiling zone under the Red Hills” geological model correct (after teasing it with hole 136) and add some critical high-grade ounces to their project. Mike and I chat about all this, the market response to their results, the importance of the leach pad land acquisition, insider support, and more.

Part 1: The Interview, Part 2: The Companion Article, Part 3: The Written Summary

Part 1: The Interview

Timestamps

00:40 March 19th news – drill results 04:00 Hole 136 09:00 Update on holes and meters drilled to date? 12:00 Cash on hand and leach pad news 15:30 Final Thoughts 17:30 Follow-up on PEA and Resource timing

Part 2: The Companion Article

I’ve put quite a bit of time into Arizona Gold & Silver this year – I toured the site last February, for example. And while I’ve had to take a breather to focus on the rest of the companies I work with, AZS of course continues to move forward.

So, with a few important news releases to their name since we last spoke, I sat down with CEO Mike Stark again for an update. Topics included drill results, land acquisition, company strategy, and corporate finances, among others.

Drill Results Overview

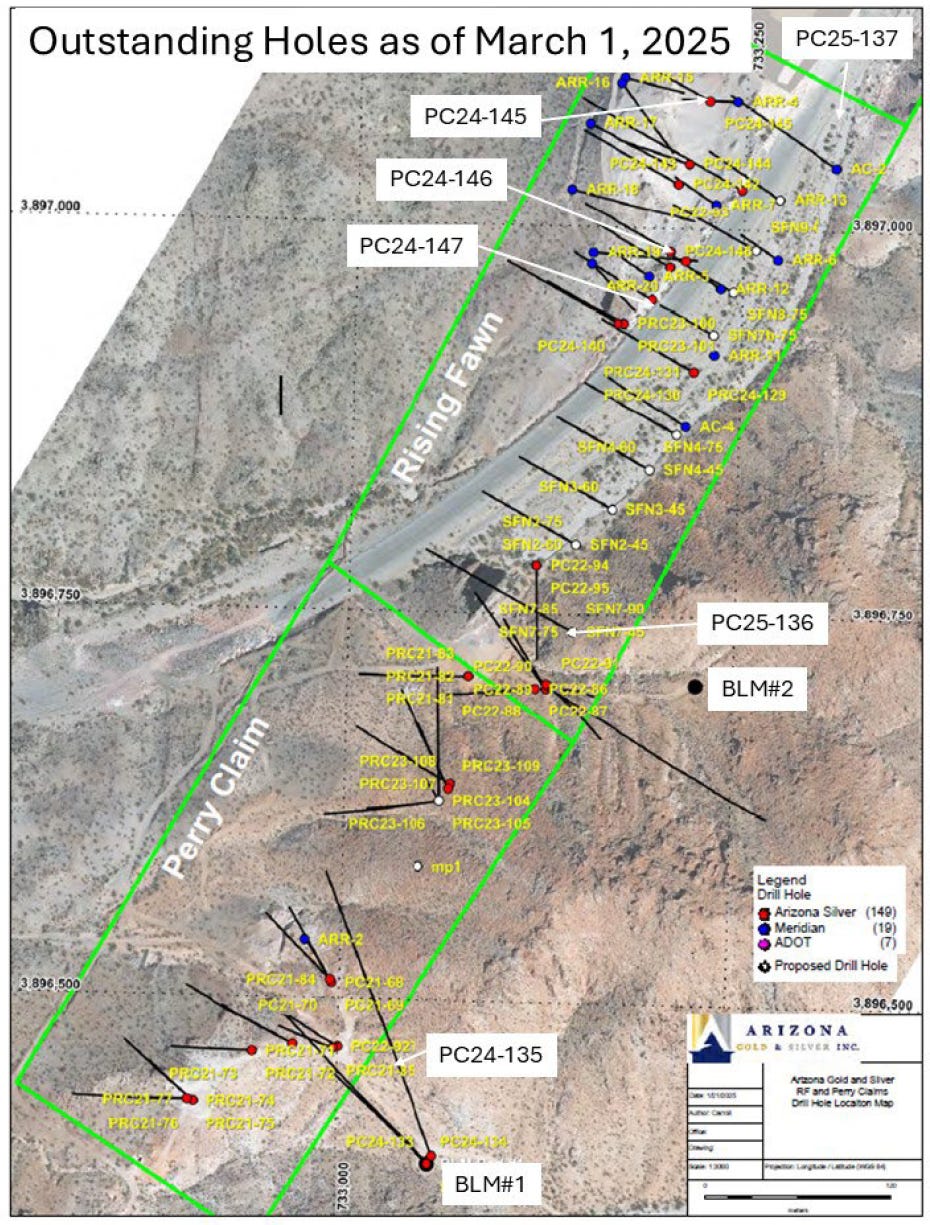

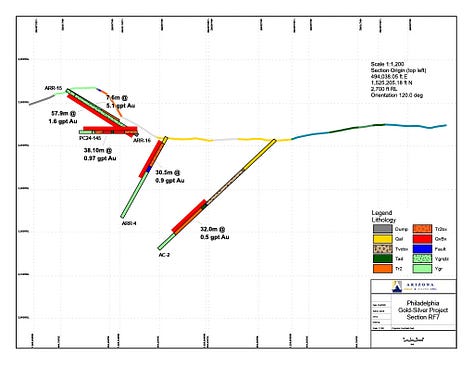

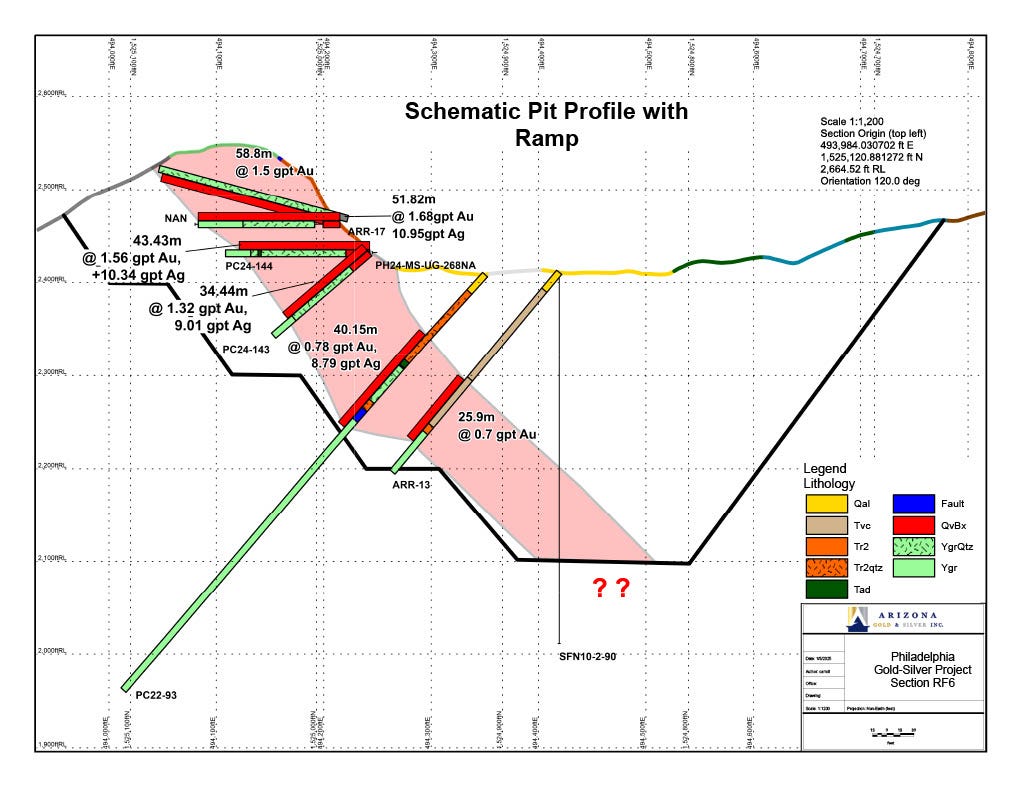

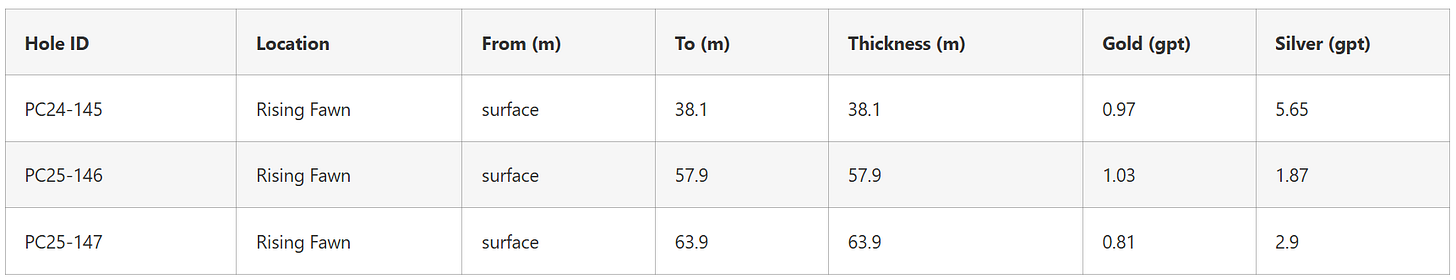

Drill Results #1. March 19 – Holes 145, 146, 147

- News release here.

- Infill drilling for upcoming maiden resource at Rising Fawn.

- Lots of mineralisation right from surface. Mineralisation widths of 38.1, 57.9, and 63.9 meters (all hits directly from surfce)

- Collectively the three holes had 159.9 meters of 0.93 gpt Au.

- Horizontal into the edge of an outcropping hill and fanning into

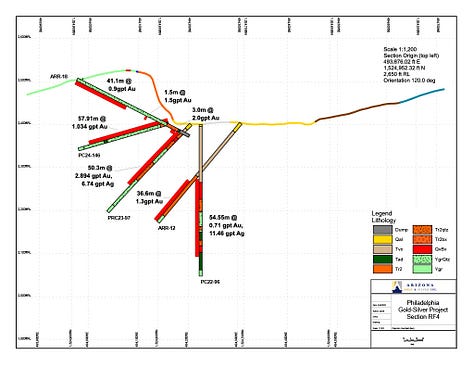

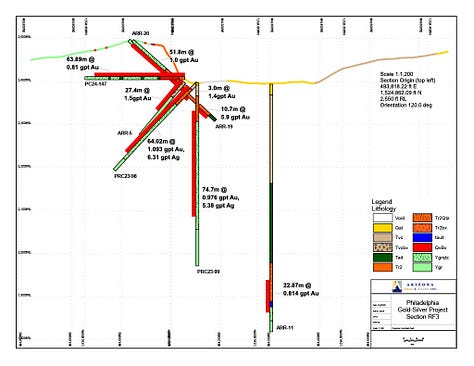

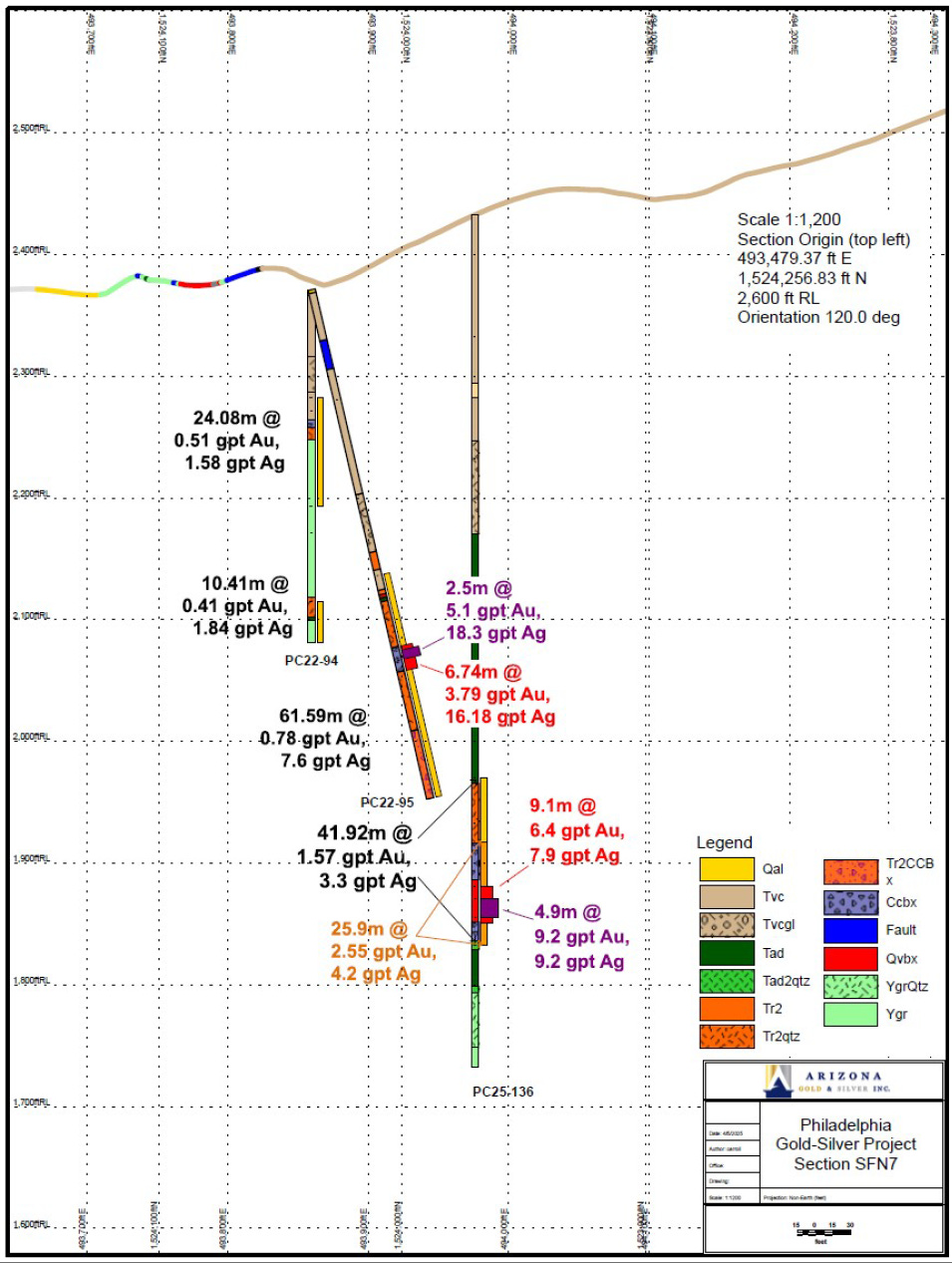

Drill Results #2. April 7 – Hole 136

- News release here.

- Discovery drilling.

- Came in just above the boiling zone – “This intercept looks to be shallow in the vein system that bodes well for continued success as we drill deeper.”

- Highlight intercept of 4.9m of 9.2 gpt Au from 171.2m down hole.

My Thoughts

There’s an axiom in the resource sector to only invest in projects with the potential to become tier one discoveries. The logic is that the space is just too risky to spend your time on projects with smaller rewards.

And there’s another popular axiom that is generally pretty solid: “Grade is king”.

And, generally, both of these are smart, accurate, takes on the sector. To a point. Both serve as a sort of shorthand, internalising a sort of “cause and effect” of inputs and outputs in this industry. What both are saying is that, above all else, it’s the economics of the deposit that matter. And the simplest and purest evidence of strong economics are big, high-grade deposits. But these critically are not universal truths and there are important exceptions to this general ideas.

And this is why I like AZS, even if it is a bit more humble than, say, a Snowline or a Founders. Even if the numbers are smaller here, the economics could still be very strong at Philadelphia because of all the positive characteristics it possesses. Analogues in the region and AZS’s own work shows that Philadelphia is one cheap project. Shallow mineralisation. Open pit. Heap leachable. Excellent jurisdiction and location.

These together make me believe Philadelphia punches above its weight class. Economic viability is comparatively a very low bar for AZS to hurdle. Go take a look at Moss Mine or other heap leach projects you know in SW USA. Those AISCs are low. Cut-off is low. $/tonne is low. And margins are high.

Now, Arizona absolutely needs a 43-101 resource estimate and PEA to demonstrate this. I don’t expect the market to take my – or their – word for it, but I can tell you now if they end up with 1-2 million ounces of ~1 gpt heap leach material within 200 or 250 meters of surface that the boilerplate economics on that PEA are going to be surprisingly compelling for such a comparatively small project.

So holes 145, 146, 147 – those being 40, 50, 60 meters of 1ish gpt material from surface – are the kind of sneaky good results this project has. They aren’t ever going to be the headline article of mining.com, but they absolutely are the kind of results that open pit heap leach mines are built out of. AZS has a ways to go yet, but so far they have the ingredients for success. Hole 136, meanwhile, is a bit of a different animal.

Market Response to 136

So hole 136 – even though we knew it wasn’t in an ideal placement to properly get into the boiling zone at depth (they’ll need to step out to BLM Pad 2 for that) – still had expectations around it.

And you can see the results above. Good, but not “wow”. Hole 136’s highlight assay of 4.9m at 9.2 gpt Au from 171m down most importantly seems like it confirms their model anticipating increasing grade at depth as they approach the boiling zone. (Heck, flip it on its head – imagine how bad it would have been if 136 came back barren… THAT is the kind of result that blows up a geological model.) But the market responded fairly poorly, giving back some 30% or more from 45 to 30 cents or so (though now looking to have recaptured an uptrend).

So why?

Well, for one thing, true widths of only 50% takes the starch out of these numbers a little bit. Why the narrower results? Basically because they’re still in the conduit up to surface and are trying to get down into the belly of it.

Additionally, there may have been hope for a wider swath of disseminated mineralisation outside the highlight assay to better match ideal open pit conditions. The 25.9m of potentially ore-grade material (actually 12.95m, of course, given 50% true widths) isn’t as fat as you want to see in a bulk tonnage situation.1

But these issues being taken seriously seem mostly to hinge on the market believing 136 to be the key, defining hole in this program. But as I discussed above, this isn’t the defining hole because this isn’t the boiling zone. Yet.

Rather, the results from BLM Pad 2 (apparently they’ll be spudding any day now) seem to be much more the place to watch. Stepped back, it will get deeper, at a better dip, and thus hopefully be able to fully lance into the guts of the boiling zone.

Indeed, the 14 hole drill program planned for BLM Pad 2 will much more fully tell the tale of what the Red Hills are hiding beneath them. That’s the potential I am here for. You never know for sure until you drill, but evidence seems good there’s something down there. And AZS has the cash to find out what it is. And that’s a pretty good spot to be.

Why am I saying all this in what is meant to be a brief news update? Well, I want my followers to make money. I want them to be involved with wins and build the wealth this sector can create so rapidly for people. So I take this AZS downswing – whether it is fair or unfair – a little personally. I called my shot of AZS being a high-potential win in 2025 and it is down ~30% since then.

If you’ve followed my picks, you will know I have had a few solid 2025 market wins new to my JRI portfolio already (Contango, Miata, Orosur), but the losses impact me more. Of course, you can’t win ‘em all, but batting average matters in my game.

So if you’re reading this and are frustrated at the drop – take heart. I don’t think this story is derailed the way a 30-40% drop might make you fear. The boiling zone coming good still seems a reasonable hope, though no one likes the uncertainty merely “okay” results produce.

Does AZS need to have its boiling zone thesis emphatically confirmed to justify further growth? Of course. And that’s exactly what they’re drilling to find out. Everything else at this point is up to mother nature.

Financials, Leach Pad, Conclusion

Mike also discusses the recent news that AZS has acquired land for a future leach pad just a mile or so down the highway from their main drilling area. This is one of those “quiet but important” updates. I wouldn’t expect anyone to shove all-in on such news, but it is still an important piece of the puzzle for AZS. Having the ability to tell potential suitors that they can realistically go it alone is bargaining chip that gives AZS options and, therefore, power.

Anyway, that’s it for now. AZS remains a project I believe has an inside track at making it to (lower throughput capacity) commercial production, are actively drilling and on the cusp of spudding some critical discovery holes. Merely okay results from 136 were likely misinterpreted and negatively overinflated by a precarious market. They need a win from BLM Pad 2 to keep going up and the right from here, but they’ve got enough data to be hopeful and enough money to make it happen.

Watch this one.

Thanks for reading.

-Matthew from JRI

Part 3: The Written Summary

00:40 March 19th news – drill results

- Holes 145, 146, 147 – all solid. 40, 50, 60 meters of roughly 1 gpt material right from surface.

- In-fill – important additions to resource.

- They have continued to proceed along strike – now on hole 151 – and continue to hit mineralisation in each hole.

- Beginning to chase it downdip now.

- Horizontal holes are done, now they’re walking their way down to the edge of the patented property boundary by their “shark fin” formation.

- Once that’s done, it’s time to head up to BLM Pad 2 to try to get down dip of 136 and fully into the boiling zone.

04:00 Hole 136

- Hole I was present for and saw core of during site visit.

- One you and your team were excited for.

- I don’t think the hole got overhyped, but there seemed to be a bit of a slow-motion sell-off in the market of AZS after its results were out. Why did the market respond as it did?

- Mike: Bit of a combination of things.

- The October financing became free trading.

- Macro market is obviously jittery too, and it came out at the peak of that uncertainty.

- Mike: Bit of a combination of things.

- Why true widths of only 50%? Is it smaller than anticipated?

- Potential partners with signed CAs expressed happiness with the results.

- They aren’t quite at the boiling zone yet. Still above it.

- They just need to keep drilling to figure the system out at depth.

- 100m above 136, hole 95 hit 5 gpt Au. 136 hit 9.2 grams. So grade is increasing with depth.

- The boiling zone – if they’re correct – should see even higher grade yet.

9:00 Update on holes and meters drilled to date?

- 7 holes are in lab already, plus 3 more delivered yesterday.

- 8 holes have had results released so far.

- One more hole that is nearly finished, but drillers are on their 10 day break. Once that’s done, it’s onto BLM Pad 2.

- That one will first go under 136 to see what’s down there. Will get a better true width.

- BLM Pad 2 has a 14 hole program designed for it. Planned to go about 150m laterally and about 150m deep initially.

12:00 Cash on hand and leach pad news

- $3.2 million in the treasury just announced.

- Insiders have been constantly buying in the market and exercising options.

- Brady Stiles and other insiders have exercised well in excess of $600,000 worth of options in 2025.

- Insiders have also bought over $65,000 on the open market in 2025 so far.

- After doing $4.6 million with Sprott in October, after 6 months and over 3000m of drilling to date they still have $3.2 million.

- Proud of how much support the team has shown the company.

- Leach pad land acquisition

- An important update

- Puts AZS in a position to be able to take this into production themselves if they want.

- Their current land package is too rugged for a leach pad.

- Land is at a premium in their region and they’re glad to get it staked.

- Could potentially serve as pad for other operations as well.

15:30 Final Thoughts

- Trying to cut a deal without a leach pad to DIY puts you at a big disadvantage.

- They will continue to steadily move the project forward.

- Being done slowly and carefully.

- 100% hit rate on current program.

- Perfect location for a mine – water, leach pad, infrastructure, highway, etc.

17:30 Follow-up on PEA and Resource timing

- In discussions with company right now to produce 43-101.

- Don’t want to rush into one before current drill campaign in case there’s further discovery in and around 136.

- They have lots of area to explore still.

- 43-101 does help with institutions and larger investors.

- There will be very little inferred – VPX Greg Hahn has placed drill holes approrpriately for M+I.

- Hopefully 2025 but could be 2026. Depends on when they stop producing data for it.